Market Pulse: Feeder Pig Prices Show Modest Gains Amidst Shifting Agriculture Landscape

Pig producers witnessed cash feeder pig prices climb to an average of $82.94 during the third week of April 2025, representing a minor elevation of $0.13 from previous market figures. This subtle upward momentum arrives during a season where agricultural markets typically encounter seasonal pressures. The minimal gain, while not substantial in isolation, marks a promising deviation from March statistics when prices plummeted to $52.05, displaying a swift decline of $1.90 compared to preceding weeks.

Industry observers note these figures with cautious optimism. Market dynamics have transformed dramatically since late March, when weaner breakeven calculations hovered around $60.86 – a figure that has undergone substantial refinement to $48.73 by late April. This adjustment demonstrates a $5.15 advancement for producers within a single week, creating breathing room for operations managing tight margins.

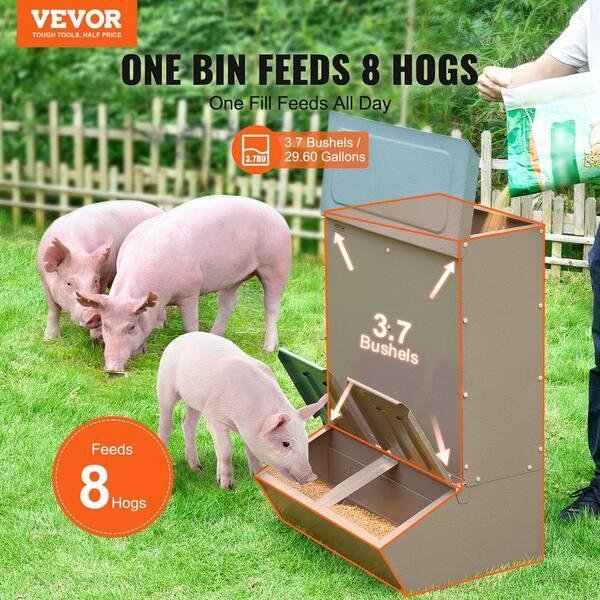

Feed expenditures have shifted downward, dropping $1.37 per head in recent calculations. The financial burden of nutrition remains a perpetual challenge which farmers navigate through unpredictable grain market conditions. October futures increased by $1.80, providing additional foundation for long-term planning considerations by producers who routinely lock prices many months ahead.

The total receipt volume reported for the week ending April 25, 2025, reached 102,475 head – a crucial benchmark when evaluating market health across production regions. Receipts serve as windows into overall industry activity rather than simple transaction logs.

Early-weaned pigs weighing 10 to 12 pounds demonstrated varied pricing structures dependent upon lot size. Smaller groupings under 600 head commanded $39.00 to $41.00 per head, while sizeable lots exceeding 1,200 head enjoyed broader pricing ranges from $34.00 to $54.00, averaging $45.06 delivered. These price differences highlight how volume continues influencing transaction values in contemporary agricultural commerce.

Looking beneath market arithmetics, the composite weighted average for early-weaned pigs settled at $44.81 delivered – a notable enhancement compared to previous week’s $41.68 and last year’s figure of $41.54 during comparable timeframes. This year-over-year improvement suggests underlying sector stability despite intermittent volatility.

Producers facing decisions about herd dynamics should acknowledge how futures markets signal optimistic outlooks extending into summer months. May 2025 lean hog futures were reported at 92.225s, while June contracts pushed into triple digits at 100.275s. These forward-looking indicators provide decision-making frameworks when producers contemplate expansion versus maintaining current production levels.

Weekly slaughter figures reported through April 26, 2025, reached 775,000 head carrying an average weight of 291.6 pounds – exceeding both week-ago counts (749,000) and year-ago figures (761,000). The weight increase compared to 2024 statistics might reflect production adjustments or feed efficiency improvements throughout the supply chain.

The marketplace continues adapting through equilibrium seeking behaviors between suppliers and processors. Negotiations between parties establish baseline valuations that ripple outward across all transaction types within the industry ecosystem.

Regional disparities exist in how producers approach their marketing strategies. Some emphasize weight gain efficiencies before transport, others maximize throughput volume targeting lower per-unit fixed costs. Neither approach guarantees superior outcomes across all market environments – flexibility remains essential for sustained operational success.

Some analysts insist that current market conditions favor producers with diversified revenue streams, though ironically, specialized operations have demonstrated surprising resilience during recent market disruptions. This apparent contradiction suggests traditional wisdom about diversification may require renewed scrutiny under current economic conditions.

The dance between supply and demand continues its erratic choreography, with producers constantly adjusting their steps to match changing music. As one old-timer at the auction barn remarked last week, “These pigs ain’t getting any cheaper to raise, but somehow we keep finding ways to make it work.” This sentiment captures the pragmatic persistence characterizing today’s pork production sector.

For producers navigating these complex waters, strategic planning represents not just good business practice but essential survival tactics in an increasingly competitive landscape where margins fluctuate with the persistence of Midwest weather patterns.