Global Hog Production and Pork Market: Size, Trends and Forecast Analysis

The dynamic landscape of global hog production continues to evolve with swift transformations occurring across key markets worldwide. As of April 2022, the global pig population stood at approximately 778.64 million, with China housing more than half of the world’s pigs. This concentration presents both opportunities and vulnerabilities for the global pork supply chain.

Production Outlook

Global pork production for 2025 is projected to reach 116.7 million metric tons, representing a modest uptick of 0.2% compared to 2024 levels. This plateau-like growth masks significant regional variations that warrant closer examination by industry stakeholders. Brazilian and American producers are expected to elevate their output, effectively counterbalancing decreases anticipated in the European Union and China.

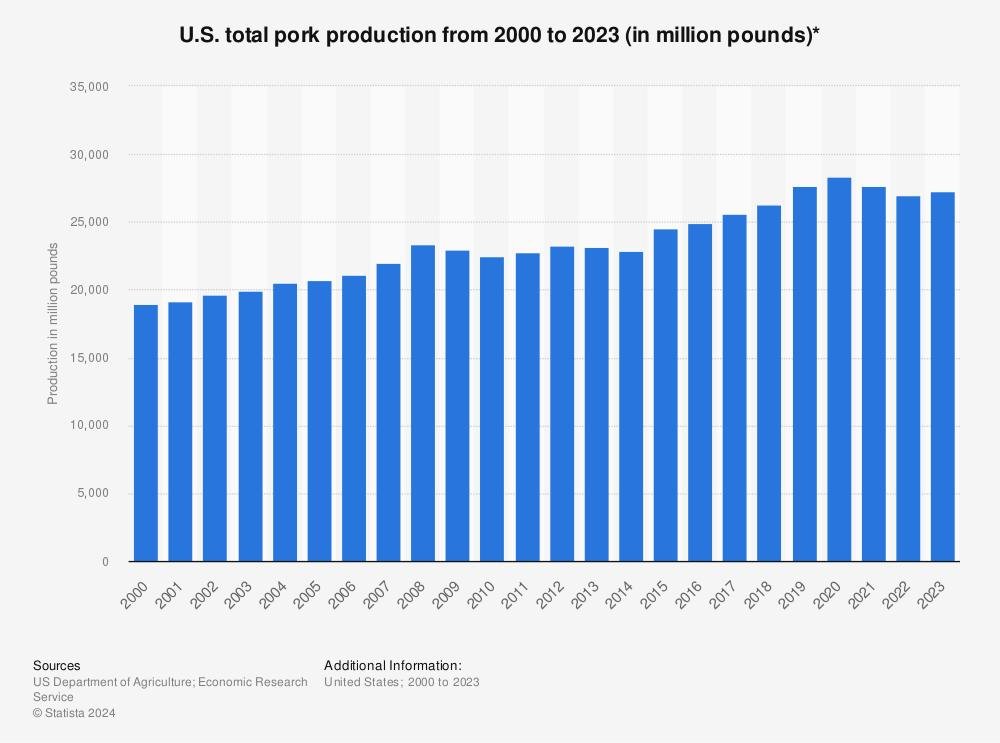

The United States holds particular interest for market watchers. Following the March Hogs and Pigs Report, experts adjusted their forecast for 2025 U.S. pork production downward to 28.1 billion pounds, a reduction of approximately 350 million pounds (1.2%) from previous estimates. Despite this recalibration, U.S. hog production is still expected to climb by 1% year-over-year to reach 12.7 million metric tons. This growth is primarily attributed to heavier slaughter weights that will compensate for the reduction in animal numbers. Lower feed costs throughout 2025 will likely incentivize producers to push for increased weight gain.

The European Union’s pork industry faces headwinds from multiple directions. A 1% decrease in EU pig production stems from a confluence of factors – shifting consumer preferences, animal disease propagation, and regulatory pressures. These challenges highlight the complex interplay between market forces, biological realities, and policy frameworks shaping the industry’s trajectory.

Regional Transformations

China, as the dominant force in global pork production, continues to influence market dynamics substantially. In 2024, China produced over 57 million metric tons of pork, cementing its position as the world’s largest producer. However, looking ahead to 2025, analysts predict lower pig slaughter volumes in China due to reduced sow numbers – a consequence of depressed pricing and ongoing industry consolidation. Interestingly, improved pig performance with higher piglet numbers per sow has diminished the need for maintaining larger breeding inventories, enabling production efficiency despite fewer breeding animals.

Brazil emerges as a bright spot in this landscape, positioning itself to capitalize on trade opportunities. With competitive production costs and strategic market positioning, Brazilian producers are poised to expand their global footprint, particularly as traditional exporters face constraints.

Trade Patterns and Market Implications

The international trade outlook for pork in 2025 presents a slightly muted picture compared to previous years. Global exports are forecast to decline by 1.4% from 2024 levels, dropping from 10.3 to 10.2 million metric tons. This contraction reflects reduced exportable supplies from major producers and demand uncertainties in key markets – especially throughout Asia.

U.S. exports are expected to fall by 2% in 2025, hampered by market uncertainties and supply limitations that will constrain export opportunities. The USDA attributes this decline partly to lower anticipated demand across most Asian markets, which will restrict overall export growth potential.

Conversely, global pork imports are projected to reach 9.1 million metric tons in 2025, representing a slight increase of 1.0% compared to the previous year. This modest growth in import demand could provide valuable outlets for producers in countries with expanding output.

Canadian exporters face challenges similar to their European counterparts, with reduced exportable supplies constraining their market presence. Brazilian exporters, meanwhile, stand ready to leverage the unstable trade environment and their cost advantages to explore fresh market openings.

Looking at consumption patterns, apparent global pork consumption is expected to inch upward by 0.5% in 2025, climbing from 115.1 to 115.6 million metric tons. This gentle ascent suggests steady consumer demand despite various market pressures and economic uncertainties.

The pork industry sits at a crossroads where production efficiency, trade politics, and consumer preferences converge to shape its future. Players who can navigate these waters with foresight and flexibility will find themselves better positioned to weather the inevitable storms while capitalizing on emerging opportunities in this essential protein market.