The global pig industry has witnessed a remarkable transformation in recent months. Industry experts note a substantial 14% surge in pig production, defying earlier conservative projections. This elevates the worldwide pork output to unprecedented levels, with total production hovering near 116.7 million tons for 2025, representing a marginal change from previous year statistics but masking significant regional variations.

Regional Dynamics and Market Forces

Brazil emerges as a luminous performer in the pork production arena. The South American giant anticipates a 2% expansion in production, reaching approximately 4.6 million tons. This growth stems primarily from robust profitability during the preceding fiscal cycle and persistent international appetite for Brazilian pork products. Their export volume is poised to climb by 5%, as Brazil maintains its position as a budget-friendly supplier while simultaneously extending its market reach.

The European Union, conversely, faces a downward trajectory. Production figures show a 1% reduction, bringing total output to 21.1 million tons. This dip results from a complex interplay of factors. Consumer preferences have undergone a swift evolution, animal health challenges persist, and regulatory frameworks continue to exert pressure on European swine enterprises. The continued diminishment of herds contributes to reduced slaughter volumes, while elevated feed expenses constrain pig weight development.

The United States presents a unique situation where following the March Hogs and Pigs Report. Total 2025 pork production forecasts now sit at 28.1 billion pounds, reflecting a reduction of approximately 350 million pounds from earlier projections. First quarter inspected pork production hovered around 6.9 billion pounds, which was 2% lower than 2024 figures, although slightly heavier average dressed weights offset some effects of reduced animal numbers.

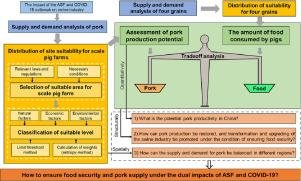

China, despite housing over half the global pig population, experience ongoing industry contraction. Lower pricing has forced a reduction in sow numbers, though this is partially mitigated through enhanced pig performance and improved piglet yields per breeding animal. These efficiency gains reduce the necessity for maintaining extensive sow inventories that were characteristic of previous production models.

Trade Landscape Transformation

The global pork trade shows signs of being somewhat subdued for 2025. Overall exports are projected to decline by 1%, settling at approximately 10.2 million tons. This downward adjustment stems from decreased export volumes from the European Union, United States, and Canada, though Brazil’s export growth provides some counterbalance to this trend.

European Union exports are estimated to diminish by 4% due to constrained exportable availability and heightened competition in several pivotal markets. Canadian exports face a similar 4% decline, attributed largely to demand uncertainty within its principal markets.

The trade situation is complicated further by market uncertainties affecting American exports. Brazil, meanwhile, is strategically leveraging the unstable trade environment and its advantageous production cost structure to explore fresh opportunities and expand its global footprint in the pork sector.

Production Efficiency and Industry Outlook

Production techniques have undergone remarkable refinement across the sector. Improvements in breeding technology have yielded dramatic increases in piglet numbers, which consequently reduces dependency on maintaining large sow inventories. Feed conversion ratios continue to improve despite volatile input costs that challenge producer margins in some regions.

The industry’s flexibility was demonstrated when second-quarter 2025 production was revised. Initial forecasts suggested a 2.4% increase compared to the previous year, but adjustments following the March Quarterly report moderated this to approximately 1% higher than the same period last year. This adjustment reflects the industry’s capacity for quick recalibration in response to emerging data.

Despite these positive developments, the pig farming landscape remains fraught with challenges. Animal disease concerns, ever-evolving regulatory frameworks, and shifting consumer preferences cast long shadows over future growth prospects. Environmental considerations increasingly influence production decisions, with sustainability becoming not just a buzzword but a essential component of strategic planning.

The coming quarters will determine whether this production surge represents a temporary blip or signals a fundamental restructuring of global pork production capacities. What remains crystal clear is that adaptability and technical innovation will separate tomorrow’s industry leaders from those left wallowing in outdated practices.