The U.S. pork sector tumbles forward into 2025, a year forecasted to diverge from recent volatility, with indicators—at first glance—pointing toward stabilization and renewed profitability. Dominion over the landscape belongs not solely to producers, of course; processors and global demand play outsized roles that are shifting beneath the industry’s feet.

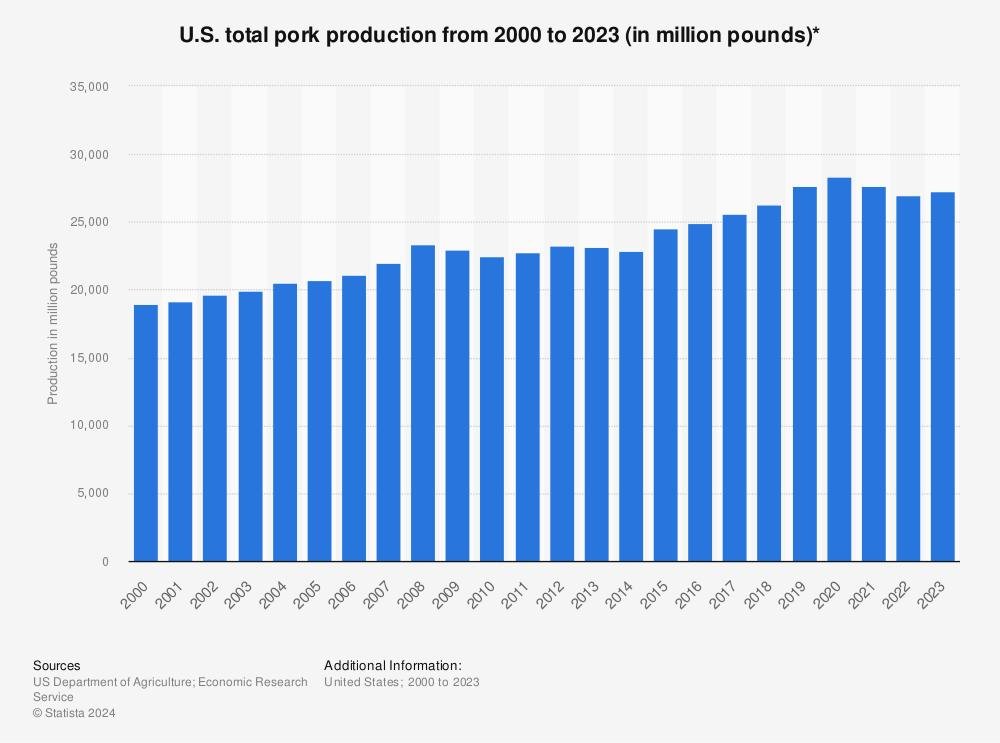

Production numbers tell part of the story but elide some subtlety. January offered an almost modest lift—U.S. pork production up nearly 1% year-over-year (that’s roughly 2.5 billion pounds for those counting), spurred by higher slaughter volumes and marginally increased carcass weights. It’s a small jump relative to other years yet feels more significant coming after a period rife with uncertainty. Seasonally variable input costs aside, many in agribusiness regard any growth as reinforcing confidence for expansion.

Ironically, however—and this is telling—a modest reduction actually took place in overall hog inventories by March; market hogs recorded at 68.5 million head on March 1, just under both last year’s figure and down one percent from last quarter. It stands slightly paradoxical: simultaneously seeing a bump in output whilst walking back total inventory numbers—not so much contradictory as it is reflective of market recalibration strategies intended to avoid oversupply issues witnessed previously.

Despite nuanced production changes, pricing has followed its own tempo in early 2025. Differentials became conspicuous as live hog prices averaged $80.19 per hundredweight this January—a leap exceeding nineteen percent compared with twelve months earlier. Wholesale pork prices showed similar buoyancy near $91/cwt., evidence enough of strong consumer demand propping up margins for packers no matter their rising feed and labor expenses.

International dynamics? Not immune from turbulence—export figures hold their own surprises this cycle too; U.S.-origin pork exports steadied at approximately 646 million pounds last December which sounds routine until one recognizes Mexico remained steadfast as the largest destination even amid shifting currency values. What genuinely grabbed analysts’ attention was the sharp upswing (+55%) in shipments destined for China and Hong Kong offsetting slight contractions seen across Japan and South Korea markets.

Global context fleshes out domestic peculiarities further still because producers worldwide proceed with what could only be called cautious optimism instead of unchecked exuberance (despite lower feed costs rendering pork extra competitive vis-à-vis beef or even poultry). Beans may grow cheaper yet labor unpredictability remains endemic globally; thus herd expansions have progressed sluggishly outside Brazil or China while Europe continues downsizing initiatives due strictly to regulatory evolutions intersecting animal health concerns.

Meanwhile—for all talk about rising output—the actual forecasted increase rings somewhat understated: USDA pegs total U.S. pork production at around 28.5 billion pounds on aggregate through year-end, constituting just a moderate uptick (+2.7%) versus prior benchmarks rather than an explosive ramp-up many anticipated throughout late-2024 planning sessions.

Feed grains grew less expensive lately amplifying profits across sizable farms particularly—but smaller growers might caution that operating margins can narrow surprisingly quickly if disease pressure worsens locally or unpredictable surges return abruptly into input costs (it happened before). Nonetheless industry observers expect improved animal health protocols will likely buffer against substantial shocks barring new variants emerging unexpectedly at scale.

Indeed price movement inside feeder pig categories signals robust demand filtered down through supply chains: early-weaned piglets averaged nearly double past year’s value ($79 per head) while forty-pound feeder pigs exceeded $102 per head (again double previous comps). Such augmentations typically spur incremental breeding investment provided bank financing persists on favorable terms—even now though caution lingers around credit risk despite positive macro trends elsewhere within livestock sectors.

Somewhat curiously perhaps—it deserves mentioning—the ongoing transition towards enhanced productivity often produces regional imbalances obscured by aggregate data summaries: American operations report adequate supplies but regions in Western Europe face tightening inventories whereas Asian buyers now thread between heightened prices domestically versus tempting import offers externally; Southeast Asia persistently records much higher local benchmarks despite intermittent lulls tied directly to sporadic disease outbreaks reported throughout Q1-Q2 cycles this year.

Forward pricing projections offer latitude but hardly guarantee tranquility for stakeholders watching global protein markets closely amidst tapering inflation rates mingling awkwardly alongside persistent geopolitical headwinds straining logistics frameworks worldwide—not every scenario yields parity outcomes across borders or among vertically integrated conglomerates operating here at home nor abroad.

What’s clear amidst such capriciousness is that agility remains paramount moving ahead into late-2025 planning rounds as seasoned producers prepare both contingency frameworks against shocks unexpected…and strategic investments should favorable momentum persist through summer marketing windows before seasonal plateaus return accompanied by inevitable cost recalibrations come autumn harvest time—which many say will test infrastructure resilience again sooner than anyone truly hopes to expect!