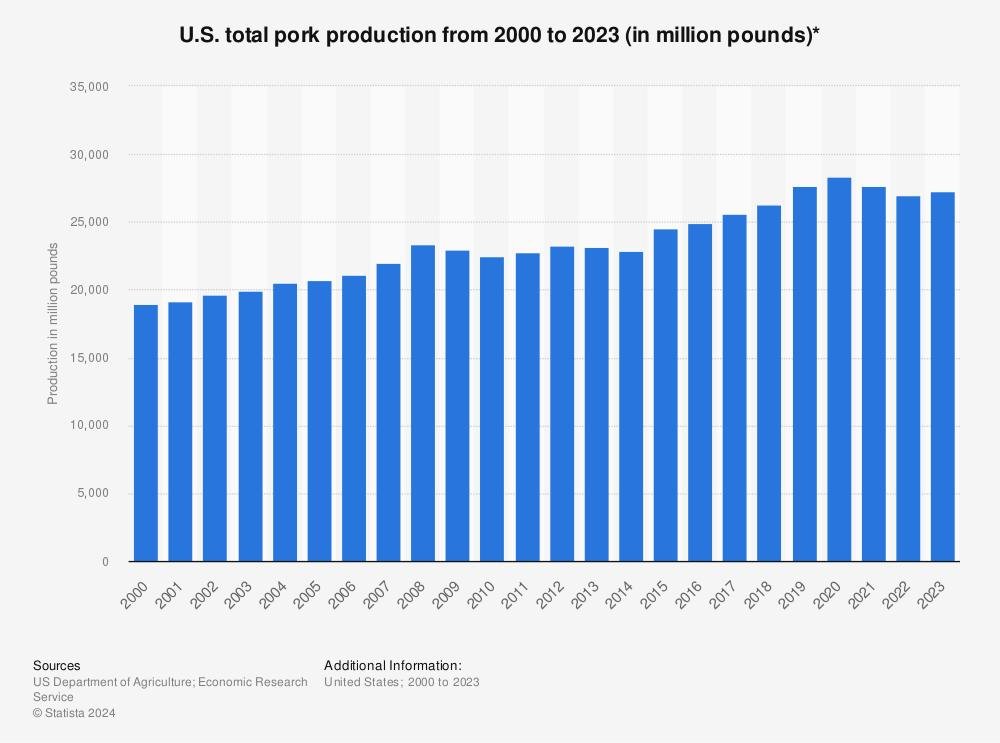

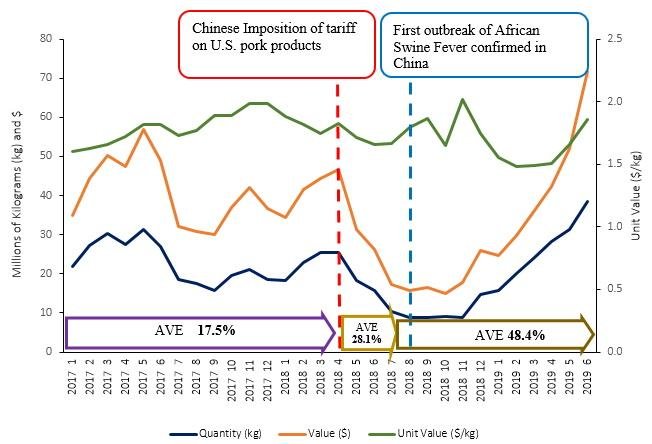

Tariffs add a layer of unpredictability and operational complexity to the pork industry that reverberates from producers all the way to consumers. The ripple effects seldom unfold in a straight line, often catching stakeholders by surprise at every link in the value chain. When new tariffs take effect—such as China’s recent hike on U.S. pork exports, now imposing a countermeasure-laden 81% rate—the ground beneath global trade networks shifts with unexpectedly forceful consequences.

Higher tariffs mean higher costs, but precisely where those are absorbed isn’t always immediately clear. For many U.S. hog farmers, who depend on export markets like China for roughly 15% of sales volume annually, these loss-of-access episodes shrink margins almost overnight and render long-term planning fraught with risk rather than opportunity. Indirect inputs—feed grains, machinery parts imported from abroad, even veterinary pharmaceuticals—can become pricier if tariffs target key supplier nations or raw materials.

In other instances though—and perhaps paradoxically—the bullish momentum caused by reduced domestic hog numbers might offset some of the downward price pressure driven by depressed export opportunities. This market seesaw makes forecasting anything more than short-term demand an exercise in educated guesswork; last week’s slaughter numbers were down nearly 5%, compressing supply while foreign demand remains contorted by tariff walls.

Layered atop cost uncertainties is profound supply-chain disruption stemming not just from direct duties on agricultural goods themselves but cascading into ancillary sectors: aluminum and steel tariffs raise prices for transport infrastructure and refrigerated storage units essential for pork shipment logistics worldwide.

For packers dealing directly with overseas counterparts or middle-market distributors navigating these restrictions, suddenly volatile shipping schedules can derail existing contracts or render them de facto null once shipment costs spiral beyond what was assumed plausible at contract signing; such realities upend business dynamics faster than they can recalibrate operational plans adequately—even though adaptive capacity grows each year across segments within animal agriculture.

Retaliatory policies further exacerbate intricacies: when trading partners reciprocate after U.S.-imposed tariffs (as Mexico has occasionally threatened), the result is ambivalent—they may restrict only certain cuts instead of blanket bans yet still inflict enough uncertainty to stall investment or expansions slated prior to policy upheaval.

Curiously enough—and this may seem counterintuitive—increasing domestic inventories due to lost exports do not always translate seamlessly into lower consumer prices at U.S supermarkets since bottlenecks elsewhere (labor shortages at plants or limited cold storage) could keep retail prices artificially inflated despite wholesale gluts elsewhere in the system; echoing through earnings calls and market updates alike is this sense that tariff-driven shocks spread unevenly within vertically integrated businesses and independent operators alike rather than distributing their impact cleanly down each rung of commerce.

Moreover, working capital requirements swell considerably under new tariff regimes as operational overhead jumps unpredictably: insurance rates spike because delivery reliability appears murkier; bankers get more nervous about issuing lines of credit when clients’ balance sheets reflect unpredictable swings between quarters due largely to shifting trade barriers instead of production inefficiency or market misreading—a misfortune uniquely tied to geopolitics over agricultural fundamentals themselves.

The lexicon used among traders becomes peppered with risk management jargon even outside C-suite discussions—a far cry from standard grill-side conversation among rank-and-file employees supervising live inventory cycles morning-to-morning on Midwest farms unaccustomed historically (until recently) to parsing macroeconomic policy headlines so closely before breakfast feeding commences.

Further complicating matters are international regulatory disparities arising whenever major economies apply differential treatment depending upon product grade classifications: variety meats face distinctly divergent fates compared with prime cuts under specific reciprocal regimes—which doesn’t alleviate logistical headaches back home nor clarify price signals transmitted downstream throughout protein marketing structures domestically. One might think administrative continuity would lessen volatility during negotiation rounds between governments yet typically it seems merely replaced one uncertainty for another slightly less opaque kind rather than resolve underlying issues outright from exporters’ perspectives!

Unseen too are intangible industry morale effects resulting when growth forecasts get shelved indefinitely—resource allocation pivots toward defensive maneuvering instead of modernization projects that could boost efficiency longer term but fall prey quickly if liquidity constraints deepen amid continued brinkmanship abroad—or so several analysts believe according to quarterly sector-wide survey tallies circulated quietly behind boardroom doors lately; whether those fears materialize en masse remains debatable scheduled against next season’s swing factors still outlying beyond any CEO’s line-of-sight today because unlike previous cycles unsure hopes persist regarding imminent resolution via bilateral talks underway as April closes out uncertainly again this year (strangely enough there was one optimistic baseline scenario I heard last December suggesting total disruptions might actually benefit local niche processors).

No matter how advanced real-time data analytics platforms have become inside large agribusinesses over recent years—or how fleet-footed individual operations adapt their hedging strategies month-to-month—the introduction (or mere threat) of cross-border tariffs ensures neither uniformity nor easy strategic recalibration for anyone invested heavily in moving American pork abroad successfully anymore. Irony abounds: complexity increases precisely where everyone wishes most sincerely for clarity instead!