Pork Production Stability Forecast in 2025 with Opportunities for Market Growth

The global pork industry is poised for relative stability in 2025, according to recent agricultural forecasts. Production levels are expected to maintain their current trajectory with modest growth of approximately 1.3% year-over-year, bringing total production to roughly 118.7 million tonnes worldwide. This represents a recovery from previous disruptions caused by African Swine Fever (ASF) outbreaks that devastated herds across Asia between 2018 and 2021.

China, the world’s largest pork producer and consumer, continues its herd rebuilding efforts with production expected to reach 56.4 million tonnes in 2025.Simultaneously occurring, European production faces challenges from environmental regulations and disease management protocols that have limited expansion capabilities in traditional producing regions.

And yet,opportunities for growth remain abundant in emerging markets. Brazil and Mexico have shown particular promise, with production increases of 3.2 percent and 2.7% respectively projected for the coming year. These emerging producer nations benefit from lower production costs and expanding domestic consumption.

“We’re seeing a essential shift in the global pork landscape,” notes Dr. Elena Vasquez, agricultural economist at the International Livestock Research Institute. “Traditional producers are focusing on efficiency and value-added products, while emerging markets are rapidly scaling up basic production capabilities to meet growing protein demand from their expanding middle classes.”

Consumer preferences continue to evolve, creating both challenges and opportunities for producers.The demand for premium pork products – those marketed as natural, organic, or humane-raised – has grown at nearly twice the rate of conventional products in North american and European markets. Will this trend extend to emerging economies as incomes rise? Or will price sensitivity remain the dominant purchasing factor?

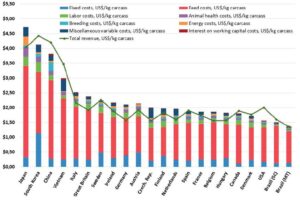

Production costs remain a significant concern for producers worldwide. Feed expenses, which typically account for 65-70% of total production costs, have fluctuated dramatically over the past 18 months. Corn prices averaged $5.42 per bushel in 2023 but are projected to range between $4.75 and $6.15 in 2025 depending on weather patterns and geopolitical factors affecting global grain markets.

Labor shortages persist across the industry. A survey of pork producers in major producing regions found that 78% reported difficulty filling positions, with processing plants particularly affected.This has accelerated the adoption of automation technologies, with investment in these systems increasing 23 percent annually since 2020.

Biosecurity measures remain critical to industry stability. The continued threat of ASF along with other diseases like Porcine Reproductive and Respiratory Syndrome (PRRS) necessitates ongoing vigilance and investment in preventative protocols. These measures add approximately $3.15-$4.00 per head to production costs but are considered essential insurance against catastrophic outbreaks.

Export markets will likely continue to drive growth opportunities for efficient producers. Japan,South Korea,and Mexico remain top destinations for exported pork,with philipines and Vietnam showing increasing import demand. Trade agreements and tariff structures will significantly impact which producing nations can best capitalize on these opportunities.

Despite challenges,the outlook for pork production in 2025 suggests a period of relative stability with strategic opportunities for growth in specific market segments and regions.