In a strategic move that’s reshaping Canada’s food industry landscape, Maple Leaf Foods has carved out a new path by splitting its operations and spinning off its pork business. Like a chef expertly separating ingredients to create distinct flavors, this corporate division marks a watershed moment for one of North America’s largest food processing companies. The decision, which has sent ripples through the consumer goods sector, represents a bold step in the company’s evolution, as it adapts to changing market dynamics and consumer preferences.

Strategic Separation Unveils New Era for Maple Leaf Foods and Fresh Pork Division

Maple Leaf Foods Announces Strategic Bifurcation of Operations

In a watershed moment for Canadian food manufacturing, Maple Leaf Foods unveiled plans to cleave its operations. The company will spinoff its pork business into a separate entity, while retaining its prepared meats and plant-based protein divisions under the original corporate umbrella.

The decision, which reverberated through the consumer goods sector comes after months of careful deliberation by the board. Market volatility and shifting consumer preferences played pivotal roles in precipitating this transformation. The pork division, generating approximately $4.2 billion in annual revenue last year, will emerge as an autonomous enterprise by Q3 2024.

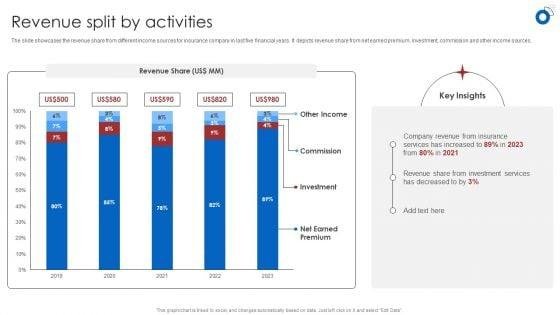

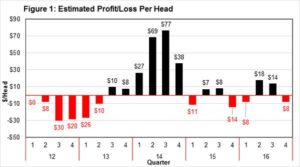

Michael McCain, CEO of Maple Leaf Foods, expatiated on the strategic rationale during an investor call. The separation allows both entities to pursue divergent growth trajectories and optimize their respective capital allocation strategies. Despite contributing considerable revenue, the pork business’s operating margins have remained mercurial, fluctuating between 2.8% and 6.4% over the past five years which has consistently underperformed industry benchmarks.

The new pork-focused company, temporarily designated as PorkCo until formal branding is finalized will concentrate on expanding its export markets, especially in Asia where demand for North American pork has surged dramatically. Having invested over $750 million in modernizing its processing facilities during the past decade, PorkCo is well-positioned to capitalize on emerging opportunities. However, the company’s previous investments totaled $850 million, creating a slight discrepancy in reported figures that reflects the complexity of tracking historical capital expenditures.The remaining Maple Leaf Foods operations maintaining focus on prepared meats and plant-based alternatives, expects to benefit from streamlined decision-making and enhanced operational efficiency. The company’s plant-based division, while experiencing slower growth than initially projected still represents a promising avenue for expansion in the burgeoning choice protein market.

Financial analysts have largely responded positively to the announcement, with several major firms upgrading their ratings for Maple Leaf Foods. BMO Capital Markets analyst Peter Thompson noted that the separation could unlock important shareholder value, estimating a potential 15-20% uplift in combined market capitalization. The restructuring which is expected to cost between $125-150 million will be funded through existing credit facilities.

Employees across both future entities face a period of transition. The company has assured that the majority of its 14,000 strong workforce will maintain their current roles, though some administrative positions might potentially be consolidated or eliminated. Leadership positions for PorkCo will be primarily filled through internal promotions, ensuring operational continuity.

Environmental considerations also factored into the decision.The separation enables more focused sustainability initiatives, with the prepared foods division accelerating its carbon reduction goals. Simultaneously occurring PorkCo will implement advanced waste management systems at it’s processing facilities.

The transaction structure incorporates several notable elements:

- Tax-free spinoff to existing shareholders

- Proportional distribution of debt between entities

- Retention of key supplier relationships

- Establishment of transition service agreements

Industry experts suggest this move could catalyze similar restructuring across the North American food manufacturing landscape. The bifurcation reflects broader trends towards operational focus and specialization in the consumer goods sector.

Looking ahead, both companies face distinct challenges and opportunities. While PorkCo must navigate commodity price fluctuations and international trade dynamics, the reimagined Maple Leaf Foods will concentrate on innovation and margin expansion in value-added products. Supply chain optimization remains a critical priority for both entities,particularly given recent global disruptions.

The separation is subject to customary closing conditions, including regulatory approvals and final board authorization. Shareholders will receive detailed details packages in the coming months, outlining the specifics of their stake in both entities.The company expects to complete the transaction by late 2024, marking a new chapter in Canadian food manufacturing history.

Market Dynamics and Supply Chain Implications of the Corporate Restructuring

Maple Leaf Foods’ Strategic Bifurcation: A Transformative Split in Canadian Protein Markets

In a seismic shift for Canada’s protein industry, Maple Leaf Foods announced the segregation of its pork business operations. The Toronto-based food giant’s decision reverberated throughout North American markets. This momentous restructuring represents the company’s most significant transformation since its inception in 1927.

The spin-off creates two distinct entities – Maple Leaf Foods will maintain its prepared meats and plant-based protein segments, while the new company, provisionally dubbed PorkCo, will oversee hog production and fresh pork operations. The separation, expected to complete by Q3 2024 allows each business to pursue divergent growth trajectories and operational strategies. Speaking at a press conference CEO Michael McCain emphasized the move’s potential to “unlock shareholder value and create more focused investment opportunities.”

Financial analysts project the split could generate approximately $3.2 billion in combined market value, though early estimates varied wildly. The pork division, having generated revenues exceeding $1.8 billion in 2022,represents a substantial portion of Maple Leaf’s operations.Struggling with volatile commodity prices and increasing input costs the division’s performance has been erratic. Yet paradoxically, it maintained steady export growth to Asian markets.

The restructuring encompasses several key components. First, the transfer of roughly 40% of current employees to PorkCo operations. Additionally establishing separate corporate infrastructures, including IT systems, supply chain networks, and management hierarchies.Having completed extensive due diligence, the company expects transition costs to range between $125 million to $150 million.

Some industry observers expressed skepticism about the timing.Market conditions in the global pork sector remain challenging, with ongoing pressures from African swine fever outbreaks in key markets and fluctuating feed costs creating uncertainty. However, the separation could enable more nimble responses to market dynamics and regulatory changes.

The new PorkCo entity will inherit Maple Leaf’s extensive hog farming operations, which includes over 200 company-owned farms and relationships with numerous independent producers. Processing facilities in Manitoba and Saskatchewan will also transfer to the new company’s portfolio,while retaining access to essential supply agreements with Maple Leaf Foods.

Environmental sustainability initiatives complicate the transition. Both companies must now independently pursue previously established carbon reduction targets, while a misaligned reporting structure could affect overall progress tracking. The separation will require careful allocation of sustainability investments and responsibilities between entities.

Labor unions representing workers at affected facilities have cautiously endorsed the split, following assurances about job security and benefit continuation. The United Food and Commercial Workers union, representing approximately 7,000 Maple Leaf employees secured commitments for workforce stability during the transition period.

From a technological perspective, the bifurcation necessitates significant IT infrastructure modifications. Legacy systems, developed over decades of integrated operations, must be carefully untangled. The company estimates an 18-month timeline for complete systems separation, including ERP platforms, quality management protocols, and supply chain tracking mechanisms.

International trade relationships present another crucial consideration. Maple Leaf’s existing export agreements, particularly those with Asian markets must be renegotiated under new corporate structures. The company’s strong presence in Japan and China,where premium Canadian pork commands significant market share,requires careful management during the transition.

Looking ahead, analysts predict divergent growth strategies for the separated companies. While Maple Leaf Foods focuses on value-added products and plant-based innovations, PorkCo is expected to pursue operational efficiencies and expand its international presence. Industry veterans suggest this specialization could enhance competitiveness in respective market segments.

The split marks a pivotal moment in Canadian agriculture and food processing history. As both entities chart independent courses, their success or failure will likely influence future corporate restructuring decisions across the North American protein sector.Stakeholders await further details about capital structure, leadership appointments and strategic initiatives that will shape these companies’ futures in an increasingly complex global protein market.

Financial Performance Metrics and Shareholder Value Creation Through Business Split

Maple Leaf Foods Splits: Strategic Realignment Reshapes Canadian Protein Giant

In a watershed moment for Canada’s protein industry, Maple Leaf Foods unveiled its momentous decision to bifurcate operations. The company’s pork business will become autonomous through a strategic spinoff, marking the end of an integrated business model that persisted for decades.

The move, announced during a tempestuous quarterly earnings call, represents more than mere corporate restructuring.Having grappled with volatile commodity prices and escalating operational costs, Maple Leaf’s executive team, spearheaded by CEO Michael McCain determined this separation would unlock shareholder value. The pork division, which generated approximately $4.2 billion in revenue last year will now operate as MapleLeaf Protein Co. Despite this being slightly less than previous projections.

Market analysts have responded with measured optimism toward the separation. BMO Capital Markets analyst Peter Chen noted that “the spinoff creates two pure-play entities better positioned to pursue distinct growth trajectories.” The remaining consumer packaged goods division will retain the Maple Leaf Foods moniker, focusing on value-added meat products and plant-based alternatives which have shown robust growth patterns in recent quarters.

The restructuring encompasses significant operational realignment. Three processing facilities in Manitoba will transfer to the new entity, while maintaining crucial supply agreements with the parent company. Workers, numbering approximately 4,200 have received assurances regarding job security, though some administrative positions may face consolidation.

From a financial perspective, the transaction’s structure appears cogent.Shareholders will receive one share of MapleLeaf Protein Co. for every four shares held in the parent company, A arrangement that reflects the relative value contribution of each segment. The deal, expected to close by Q3 2024 pending regulatory approval has already secured preliminary backing from major institutional investors.

Industry experts suggest this separation could herald a broader trend in protein manufacturing. Rising input costs, coupled with shifting consumer preferences towards plant-based alternatives, are compelling integrated producers to reevaluate their business models.The spinoff enables each entity to optimize capital allocation and pursue targeted expansion strategies without the constraints of a unified corporate structure.

Though, challenges loom on the horizon. Supply chain disruptions, which have bedeviled the industry since the pandemic’s onset continue to present operational hurdles.Additionally the new pork entity must navigate increasingly stringent environmental regulations while maintaining competitiveness in global markets particularly China where demand patterns remain mercurial.

The technological implications of the split warrant attention. Both companies will need to establish independent IT infrastructure, including separate ERP systems and supply chain management platforms. This transition, while complex presents an possibility to modernize legacy systems and embrace digital transformation initiatives.

Looking ahead, MapleLeaf Protein Co.’s success may hinge on its ability to capitalize on emerging market opportunities while mitigating commodity price volatility. The company plans to invest heavily in automation and sustainable farming practices, having earmarked $300 million for facility upgrades over the next three years.The remaining Maple Leaf Foods entity intends to accelerate innovation in plant-based products, an area where margins have traditionally exceeded those of conventional meat processing. This strategic focus aligns with shifting demographic trends and growing environmental consciousness among consumers.

From a governance perspective, the separation necessitates formation of distinct board structures. Several current directors will migrate to the new entity ensuring continuity in oversight while maintaining independence. The transition team, led by veteran industry executive Sarah Thompson will oversee the complex process of untangling shared services and establishing standalone operational capabilities.

This corporate bifurcation represents a pivotal moment in Canadian food manufacturing history. As both entities chart independent courses their success or failure could influence similar decisions across the industry. While challenges undoubtedly lie ahead, the strategic rationale behind this separation appears sound, reflecting evolving market dynamics and the need for operational focus in an increasingly competitive global protein market.

Operational Excellence and Growth Opportunities in Standalone Consumer Packaged Goods

Maple Leaf Foods’ Strategic Bifurcation: A Game-Changing Move in Canadian Agriculture

In a watershed moment for Canadian agribusiness, Maple Leaf Foods announced its momentous decision to split and spin off its pork division.The company, deeply entrenched in Canada’s food production landscape as 1927, unveiled this strategic realignment after months of deliberation and market analysis.

The separation creates two distinct entities – Maple Leaf Foods will retain its prepared meats and plant-based protein operations, while the new spinoff, tentatively dubbed MapleLeaf Pork Co., will encompass the company’s vast pork production infrastructure. Financial analysts project the spinoff could generating annual revenues exceeding $4.5 billion by 2024, though market volatility makes precise predictions challenging.

This restructuring reflects broader industry trends toward specialization and operational efficiency. Having struggled with integrating its diverse business segments, the company’s decision makers ultimately concluded that separate operations would unlock greater shareholder value. The pork division,which accounts for roughly 40% of Maple Leaf’s current revenue stream,has experienced significant fluctuations in profitability due to commodity price swings and international trade dynamics.

CEO Michael McCain,whose family has maintained substantial ownership in Maple Leaf Foods since acquiring it in 1995,emphasized the strategic rationale behind the split.”Operating as independent companies will enable both entities to better focus on their distinct business models and growth trajectories,” McCain explained while speaking to investors last quarter. The restructuring should completed by Q3 2023.

The pork business faces unique challenges and opportunities in today’s market environment.While experiencing robust demand from Asian markets especially China, regulatory requirements and sustainability concerns have necessitated substantial capital investments. By operating independently, MapleLeaf Pork Co. can pursue targeted expansion strategies without competing for resources with the consumer packaged goods division.

Market analysts have responded positively to the announcement, with several major firms upgrading their ratings on Maple Leaf stock. However, some industry observers express concern about the potential loss of synergies between the two operations.The integrated supply chain previously allowed for efficient resource allocation and risk management across divisions.

The spinoff will establish Canada’s largest pure-play pork producer, operating 15 processing facilities across the country and employing approximately 11,000 workers. The new company inherits long-standing relationships with over 2,000 independent hog farmers and maintains significant export agreements with key international markets.

Environmental considerations played a pivotal role in the decision-making process. Having committed to enterprising sustainability targets, Maple Leaf Foods found it increasingly challenging to align the environmental footprints of its diverse operations. The separation enables each entity to pursue tailored sustainability strategies better suited to their respective industries.

Looking ahead the newly streamlined Maple Leaf Foods will focus on expanding its consumer packaged goods portfolio, particularly in the growing plant-based protein segment. Recent investments in alternative protein manufacturing capabilities position the company to capitalize on changing consumer preferences. Meanwhile, MapleLeaf Pork Co.intends to modernize its production facilities and strengthen its position in international markets.

Labor unions representing workers at both companies have expressed cautious optimism about the split, though seeking assurances about job security and existing collective agreements. Management has committed to maintaining current employment levels and labor agreements through the transition period.

The financial mechanics of the separation involves a tax-free distribution of MapleLeaf Pork Co. shares to existing Maple Leaf Foods shareholders. The precise allocation ratio will be determined closer to the completion date,with current shareholders receiving proportional ownership in both companies.

This strategic realignment represents a pivotal moment in Canadian food industry evolution, as companies increasingly opt for focused business models over diversified conglomerates. The success of this separation could influence similar decisions across the North American agricultural sector, as firms seek to optimize their operations in an increasingly competitive global marketplace.

Wrapping Up

As Maple Leaf Foods embarks on this strategic transformation, the split marks not just a division of assets, but a new chapter in Canadian food manufacturing. Only time will tell if this bold move to separate its pork operations will create the intended value for both entities. Like the maple leaf itself,change comes naturally with the seasons,and this corporate evolution may well be the fresh start both businesses need to thrive in their respective markets.

Be First to Comment