Slowly but perceptibly, the latest data punctuate a swift decline in U.S. pork and beef exports for February 2025, with market participants still digesting the underlying reasons behind these ebbing numbers. Observers may recall that a year earlier, robust demand carried shipments to near-record heights; now, however, export figures are converging at notably lower levels.

Statistical Markers and Unexpected Patterns

February pork exports tallied 241,179 metric tons—a 4% diminishment from February 2024’s ample haul. Those tracking value as a crucial aspect of ag trade will find it dropped only modestly by comparison: down 2% to $671.5 million. Beef exports performed similarly sluggishly: volumes slid to 98,198 metric tons in February (a decrease of about 5.5%), while value receded by roughly $35 million from last year—settling just above $800 million.

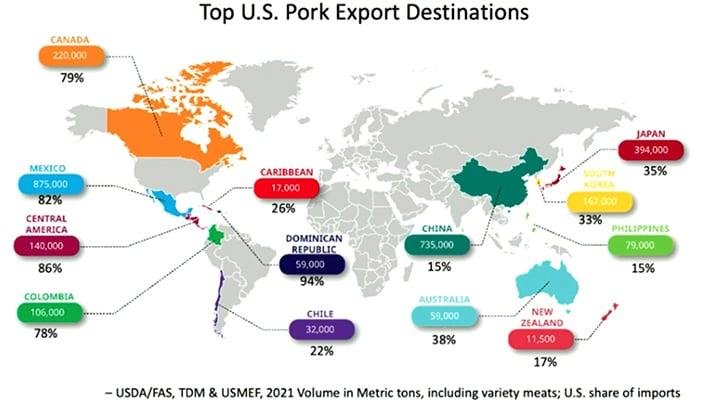

Curiously enough, some destinations bucked the broader trend. Central American importers snapped up more U.S. pork than before; Mexico’s demand proved astonishingly resilient for another consecutive month—the value surpassed $200 million there yet again. Nevertheless, faltering appetite in East Asia delivered most of the losses: “Japan and South Korea represented headwinds,” Dan Halstrom (USMEF President) stated without equivocation—though his tone later turned sandy when discussing China-bound shipments that hovered slightly higher than last year but would have flourished if regulatory questions were answered more quickly.

Whimsically—and perhaps against many experts’ expectations—the ASEAN bloc provided mild consolation as boneless pork outflows increased toward nations like the Philippines and New Zealand, albeit not nearly enough to blunt larger shortfalls elsewhere.

Causative Variables Weighing on Export Dynamics

One cannot ignore uncertainty as an invisible hand shaping these movements; plant eligibility disputes hampered Chinese orders early in Q1—the issue resolved midway through March so its effects lingered into this period even after technical clarity arrived. Whether new sanitary protocols will streamline future flows remains anybody’s guess.

Exchange rates also played backstage roles here—volatility saps purchasing power for some overseas buyers just when global protein prices might otherwise tempt fresh contracts. Such fluctuations occasionally generate irregular market behavior (“When dollar bills start tap-dancing,” quipped one analyst offhandedly).

As an undercurrent barely mentioned by partisans of only supply or demand theory alike: shifting domestic consumption patterns reconfigure exportable surpluses almost as much as policy edicts do. Bovine genetics advances promised efficiency gains two years ago—but carcass weights plateaued unexpectedly this winter.

Swerving briefly aside (as old radio hosts sometimes did), one wonders whether port congestion might return given cyclic West Coast labor talks looming—not directly related to statistics but always lurking amid trade conversations like Banquo at supper.

Secondary Market Details Concealed Among Aggregate Figures

For January-February combined totals reveal further nuance worth noting: cumulative pork shipments shrunk about 3% relative to last year’s breakneck record pace (485,144 mt versus over half-a-million in early ’24). Value was correspondingly subdued at $1.34 billion—a mere sliver below prior-year benchmarks until one plots chart lines showing lost momentum instead of isolated month-to-month tumbleweeds rolling through market newsfeeds.

Interestingly—and possibly contradictory against prevailing wisdom—exports grew YOY into not just Mexico and Central America but also Egypt; Canadian buying rose passably too while Philippine growth brought flickers of optimism despite sharp reductions elsewhere[]. For proponents focused on muscle cut differentials rather than aggregate tonnage or broad brush regional aggregates—that type of subtlety rewards close reading.

Industry Remarks Reveal Mindsets Behind Moves

Trade executives juggling logistical quandaries sounded measured rather than alarmist this cycle—even amidst contraction they emphasized “amazing” resilience southward along NAFTA corridors or Southeast Asian enthusiasm for specific offal types hardly celebrated stateside (yet prized abroad). There’s confidence that with plant certifications squared away plus emerging secondary tier markets gaining steam—in time tonnage losses could reverse course faster than critics predict.

Yet while lamb muscle cuts displayed rare five-month uninterrupted expansion streaks during this interval—a minor flourish slipped between headlines—it underscores how protein preferences oscillate globally even within shared policy frameworks or tariff regimes set far afield from country diners used every Friday night menu change-up.

Occasionally such sector-level detail fizzles before reaching broader audiences impatient with incremental shifts versus earthmovers—but those watching see opportunity beneath temporary setbacks.

Given all factors considered—it remains possible next quarter won’t mirror precisely what transpired here despite lingering challenges: seasonal rhythms can provide tailwinds just when forecasters suspect ongoing stagnation is inevitable—if recent history is ever a trustworthy guidepost except when it isn’t quite so reliable after all™