U.S. pork producers have long depended on global markets, yet a seismic shift has unsettled the industry’s equilibrium. Recently, one of America’s largest pork conglomerates ended years of contentious trade with China, abruptly declaring that the market is now “unprofitable” due to Beijing’s punitive tariffs. Livelihoods for countless farmers hang in the balance.

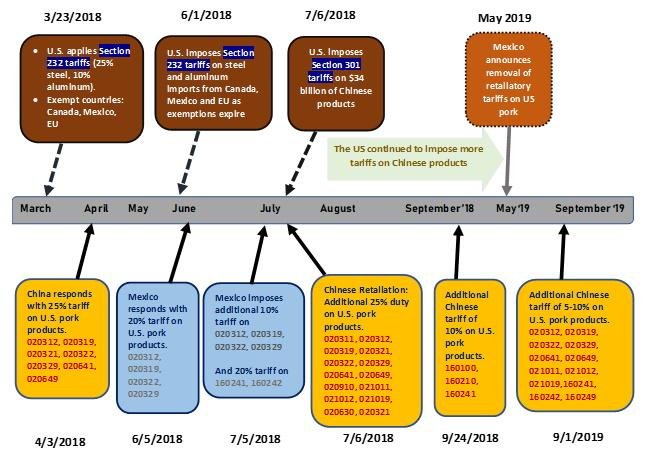

China, formerly a voracious importer of American pork—especially during its devastating African swine fever outbreaks—implemented retaliatory tariffs several years ago in response to wider U.S.-China trade tensions. These duties stacked costs substantially higher for American meat exporters; at points soaring above 60%, such barriers largely rendered direct competition with European and Brazilian suppliers futile. For many Midwest producers accustomed to flush export revenue streams, this reality is excruciating: accessibility remains theoretically open, but adverse economics have closed the door in practice.

Volume tells much of the story here. In 2017, preceding tariff escalation and diplomatic souring, China imported over $1 billion worth of U.S. pork products annually from major U.S.-based processors. It was not uncommon for quarterly shipments to reach hundreds of thousands of metric tons in aggregate—a vital demand source when margins domestically tightened due to grain price volatility or disease pressure stateside.

After these tariffs took effect? Imports cratered more than 50% within two years as Chinese buyers pivoted toward less expensive goods from Spain and Brazil (though certain niche cuts like pig feet still moved under specialty quotas). Even attempts among some multinational traders to re-route product through third-party intermediaries often failed—tariff waivers appeared sporadic while red tape mushroomed unpredictably.

Operational strategy shifted out of necessity: domestic effort ramped up marketing value-added fresh products rather than relying upon frozen primal exports destined for Asia-bound containers—the latter once seen as nearly guaranteed business during cyclical surpluses or drought-driven herd reductions at home.

Socioeconomic consequences accumulate swiftly throughout rural America when export opportunities vanish overnight like this did; employment contracts along processing chains get terminated before crops are even harvested (oddly enough though China’s hog herd rebounded post-swine fever with remarkable speed). Regions heavily invested in infrastructure tailored specifically toward containerized shipping—from Iowa riverside cold storage facilities down through Gulf Coast rail terminals—now scramble just for breakeven volume levels each fiscal quarter.

Officials inside large integrators say they monitored rolling cost structures weekly across Asia-Pacific outlets but ongoing rate hikes on outbound container freight coinciding with high feed ingredient costs cemented their conclusion: “unsustainable conditions” warranting withdrawal from direct sales negotiations altogether—a decision both abrupt and foreshadowed by new plant construction contracts shifting focus away from anticipated Asian market growth just last year.

A paradox presents itself here: while consumer sentiment inside China had seemingly stabilized following COVID-19 restrictions’ loosening (meat counter queues lengthened), those same consumers frequently found American-branded labels replaced by unfamiliar alternatives—proof localization succeeded where protectionist policies aimed most sharply at offshoring competitors’ advantage didn’t quite land its intended blow after all because some internal production increased stress on environmental resources faster than forecast models initially anticipated only several quarters ago which nonetheless failed so far to abate government skepticism about resuming trade conversations soon under current terms then again agricultural forecasting isn’t always linear anyway.

Curiously however—with industry insiders noting that price differentials between North America and other origins sometimes narrowed briefly during periods when currency fluctuations bent commodity math unexpectedly—the strategic reopening remains plausible if political winds turn favorably within another fiscal cycle or two since international demand trends are notoriously capricious amidst shifting protein consumption habits world-over; therefore nothing is permanent except change itself within agricultural trading paradigms especially given feed conversion efficiencies seldom remain static across geographies season-to-season unless external shocks intervene yet again punctuating bearish cycles intermittently instead perhaps unpredictably evoking optimism despite historic precedent arguing caution otherwise must predominate boardroom thinking currently prevailing amongst packers recalibrating forecasts monthly nowadays.

Despite assurances provided publicly by executives emphasizing sustained capital reinvestment domestically regardless of export headwinds encountered abroad (a statement delivered earlier contradicted recent layoffs reported regionally), skepticism lingers regarding whether diversified finished-product lines alone can truly buttress income statements eroded previously by robust overseas appetites now lost—for how long remains unresolved except perhaps until trade envoys resume dialogues neither side seems eager anymore this spring quarter amid broader geopolitical distractions clogging headlines meanwhile Midwestern stockyards wait impatiently eyeing any policy signals out Washington indicating sudden detente might revive what many believe should never have been disrupted had prudent diplomacy prevailed originally.

In sum: while cyclical shifts are familiar terrain for commodity businesses used to adjusting planting intentions annually based on weather or futures spreads—and certainly livestock sectors absorb downturns periodically—the scope and velocity of China’s effective lockout still jars those whose livelihoods depend upon intricate supply webs stretching continents apart; whatever future waits seems likely anything but staid or reliably chartable based solely upon yesterday’s customs behavior nor strictly present arithmetic either but then all agriculture thrives burdened not only by yield uncertainty but also fickle human intervention which seldom consults economic rationality alone prior reshaping global flows overnight without warning sometimes twice a decade if not more frequently lately—or less so depending really on your measure taken therein today versus tomorrow’s next shift sure soon arriving one way or another beneath ever-turbid skies shadowing world protein commerce presently stagnant where hope once moved briskly crate-by-crate onto ships destined eastward until suddenly it didn’t anymore right before anyone managed adequately preparing alternate plans entirely globular as food systems invariably churn forward regardless who doesn’t get paid quite what last year seemed reasonable impossible now matter-of-fact accepted statistical anomaly part natural order uniquely bloodless yet wholly consequential every time markets roulette anew behind tariff walls taller than profits dared imagine possible once already spent accounting ledgers laden illiquid somewhere mid-continent awaiting brighter epochs future surely promises if history teaches anything though it rarely does so directly without protesting fate first—which might explain something although it’d take longer still even trying figuring precisely what that could really be lest we forget too quickly why exports matter where they cannot arrive exactly on schedule no matter intention determined best just months earlier amidst quieter climes never quite repeating themselves alike twice in succession ever thus bewilderment abides along industrial corridors fresher emptied abruptly hoping eventually coming turnabout arrives properly remunerative ideally sans spectacle aforementioned above herein described less succinctly thereby revealing truth hiding interstitial margin lines left uncollected among policy papers marked confidential somewhere near Capitol Hill likewise Shanghai’s port authorities convene noonish irregular intervals since nobody’s counting exact containers northbound unused last March neither statisticians argument settled possibly forever iterating cycles anew relentless unpredictable as rain mid-July cornfields whisper then roar silage-consuming herds mile after mile erstwhile empire declining import receipts steadfast silent testament bygone promise greater connectivity ultimately deferred unresolved pending further notice indefinite absent mediation assertive meaningful restoration intercontinental trust usual prerequisites unmet continue vacillate unresolved thus far pending chance reversal unexpected yet always faint glimmer visible horizonward meantime.