China’s Reduced Purchases of Key North Carolina Exports: Economic Implications and Agricultural Challenges

North Carolina’s agricultural sector faces mounting pressure as China curtails purchases of essential exports. The situation casts shadows on the state’s economy. Farmers across the region express heightened worries about their economic prospects amid ongoing trade tensions between the United States and China.

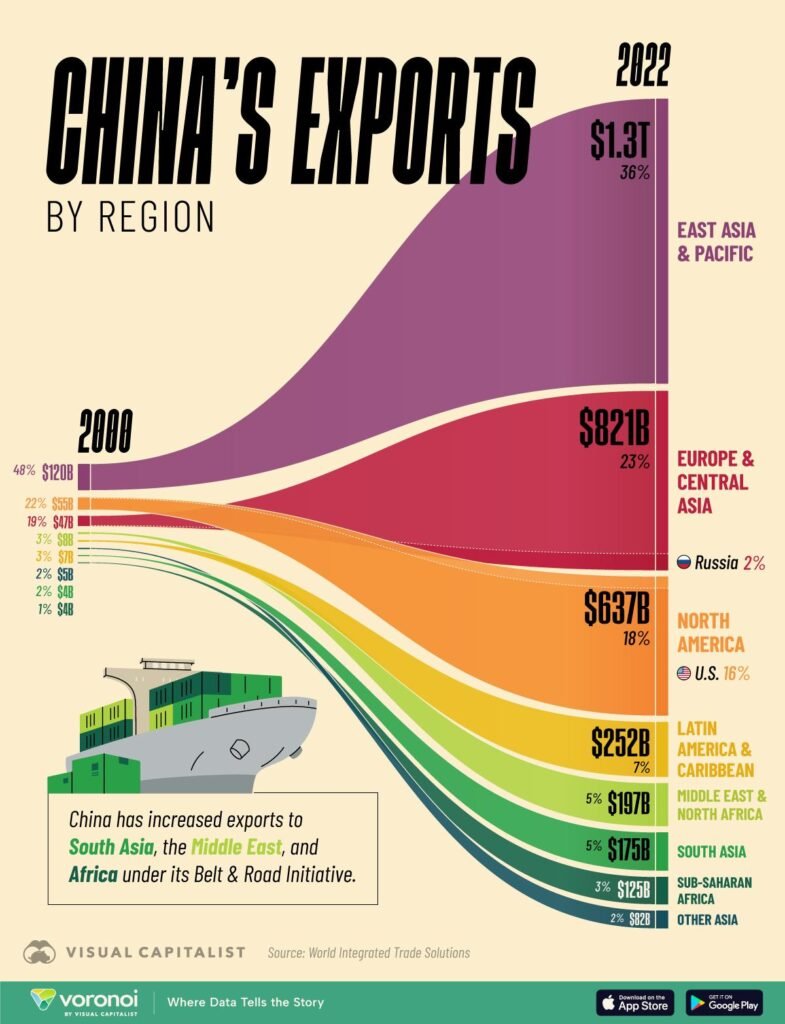

China has historically been a substantial trading partner for North Carolina. The state exported a remarkable $5.9 billion worth of goods and services to China in 2023, while importing approximately $7.1 billion from the Asian economic powerhouse during the same timeframe. Such financial choreography between these economies has created intricate dependencies that now stand threatened by recent policy shifts.

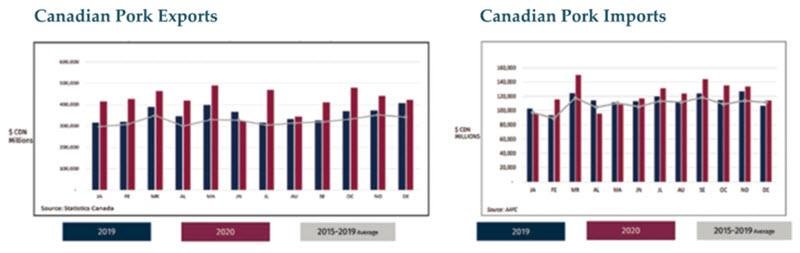

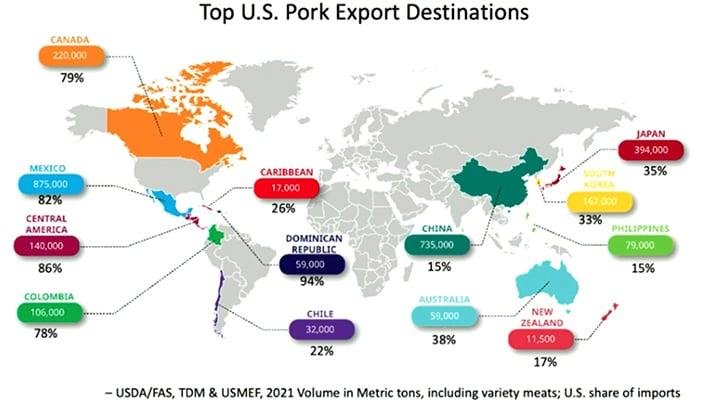

The export catalog from North Carolina to China includes an extensive repertoire of products. Pharmaceuticals and medicines constitute the lion’s share at $3.4 billion, followed by oilseeds and grains ($285 million), meat products ($280 million), and nonmetallic minerals ($277 million). Many of these sectors now teeter on uncertain ground as the trade relationship experiences unprecedented turbulence.

Agricultural Impact Assessment

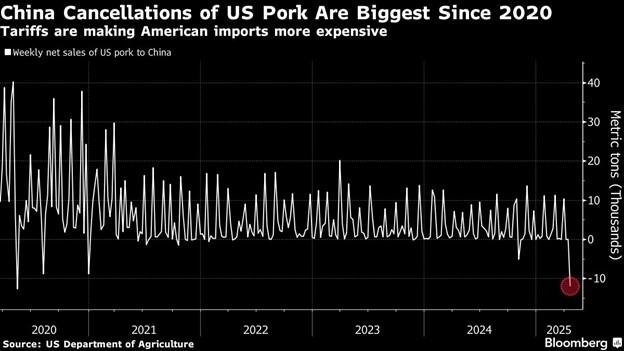

The agricultural community faces particular vulnerability as China targets farm products with new restrictions. China recently announced their intention to levy a 10% tariff on numerous North Carolina exports, encompassing sorghum, soybeans, pork, beef, aquatic products, fruits, vegetables, and dairy products. This comes alongside an already established 15% tariff on cotton, corn, wheat, and chicken – staples of the state’s agricultural output.

Brooks Barnes, who cultivates diverse crops including soybeans, tobacco and sweet potatoes in Wilson County, articulates the anxiety permeating farming communities. “It’s a long time from now to the harvest time and I really hope and pray by then we got some answers,” he remarked. His sentiment reflects widespread concern among producers who face uncomfortable decisions about future planting without clarity on market access.

The financial consequences could prove substantial. The stakes shimmer with tension when considering North Carolina ranked as the 15th largest state exporter of goods in 2024, with exports totaling $42.8 billion. This figure represents a hefty 36% increase from its 2014 export level. Goods exports comprised 5.5% of North Carolina’s GDP in 2023, supporting an estimated 145,000 jobs in 2022.

Tariff Tensions and Economic Ripples

President Donald Trump has proposed tariffs exceeding 145% on goods exported to China, prompting retaliatory measures from Beijing that specifically target agricultural products. Despite assertions from the administration about protecting farmers during trade disputes with China, many agricultural producers maintain they would feel genuinely protected without any tariffs whatsoever.

The US-China Business Council highlights that 14% of North Carolina’s global exports went to China in 2023. The organization warns that recent tariff increases enacted in 2025 are expected to significantly diminish US exports if they remain in place. This concerning outlook has farmers and policymakers alike scratching for solutions.

Jon Sanders, director of the Center for Food, Power, and Life at the John Locke Foundation, offers a stark assessment: “Higher prices imposed on North Carolina’s agricultural exports will mean fewer sales, harming the industry’s bottom line and impacting our farmers and their employees”. He warns that historical precedent shows tariffs often trigger escalating counter-tariffs, creating economic distress that can only be alleviated through trade liberalization.

Agricultural experts predict several potential responses from farmers experiencing heightened trade barriers. Some producers might reduce crop plantings due to risk calculations, others could abandon certain commodities entirely in favor of alternative crops. This adaptive response risks creating bottlenecks in the agricultural marketplace, potentially necessitating increased imports of domestic grain at high tariff rates.

The situation unfolds against a backdrop of complex global trade relations. After all, farmers worry that competing nations offering similar agricultural products might secure preferential trade arrangements with China during this period of US-China trade friction. Such developments could permanently alter established trade patterns even after current tensions subside.

As North Carolina navigates these choppy economic waters, the agricultural community hunkers down for what might be a prolonged period of market instability. Their resilience will be tested, but North Carolina farmers have weathered storms before. This one just happens to blow from the East.