As the sun rises over America’s heartland, a fresh wind of optimism sweeps through the swine industry. After weathering storms of market volatility and operational challenges, producers are finally seeing the silver lining they’ve long awaited. The pendulum has swung back toward profitability, bringing with it not just relief, but an opportunity to rebuild what was depleted during leaner times. Like farmers tending to their fields after a long winter, pork producers now face a critical moment of reconstruction, where every decision about capital allocation could shape their operation’s future resilience.

Growth Patterns and Market Recovery Signal Strong Profit Margins for Swine Producers

Swine Industry Profits Return: Focus on Rebuilding Capital

After weathering prolonged market volatility, pork producers are finally glimpsing daybreak. The swine industry’s financial landscape shows promising signs of recuperation, with profit margins expanding for the first time since late 2021. Market analysts project sustained improvement through 2024, albeit with characteristic seasonal fluctuations.

Feed costs, having reached unprecedented heights last year have begun to ameliorate, dropping nearly 22% since their peak in Quarter 3 2022.This decline, coupled with robust domestic demand, has created a propitious habitat for producers seeking to rebuild depleted capital reserves. Small and medium-scale operations, which bore the brunt of recent market perturbations, are particularly keen to fortify their financial foundations.

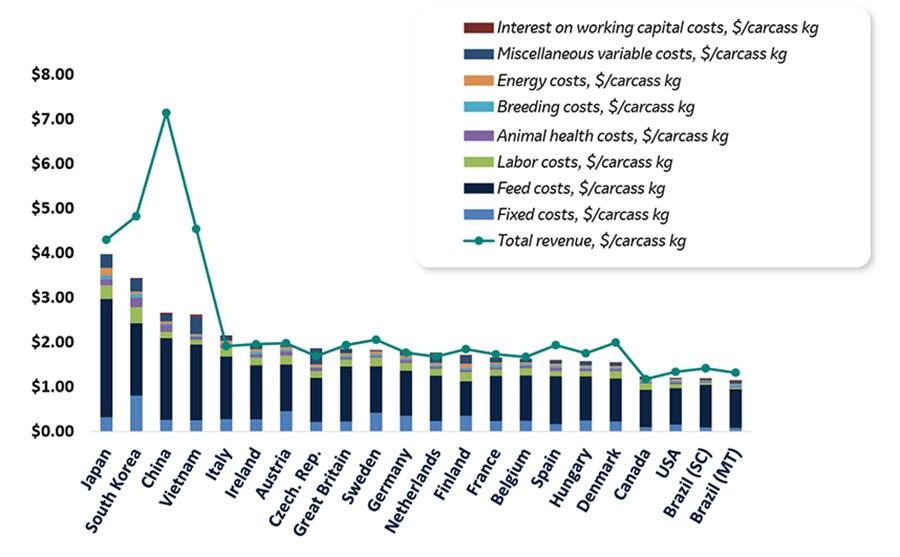

The National Pork Board’s latest industry assessment indicates average farrow-to-finish operations are generating returns of $28-32 per head, marking a substantial improvement from the negative margins that bedeviled producers throughout most of 2022. These figures varying significantly by region and operational scale. Export markets, especially demand from Mexico and South Korea, have contributed materially to this resurgence, despite ongoing logistics challenges at major ports.

Production efficiency metrics continue showing improvement across the board. Average daily gain increased 2.3% industry-wide, while feed conversion ratios demonstrating similar enhancements. Many operations implementing cutting-edge genomic selection protocols are reporting even more notable gains, though these results require further validation.

Capital expenditure planning has emerged as a crucial focus. Having deferred essential infrastructure upgrades during the lean period many producers now face challenging decisions about prioritizing investments.Equipment modernization, biosecurity enhancements, and facility upgrades compete for limited capital resources. Industry experts suggest a measured approach to reinvestment, emphasizing projects that directly impact operational efficiency.

Labor remains a persistent headache for producers.Despite offering competitive wages that exceed regional averages by 15-20%, many operations struggle to maintain adequate staffing levels. The situation is particularly acute in specialized roles such as artificial insemination technicians and herd health specialists, where expertise gaps threaten to constrain growth.

Environmental compliance and sustainability initiatives represent another significant draw on rebuilding capital. While necessary for long-term industry viability these programs often strain short-term profitability. Forward-thinking producers are exploring innovative funding mechanisms, including green bonds and sustainability-linked loans, to finance these initiatives while preserving working capital.

The industry’s genetic advancement continues apace, driving improvements in key production metrics. Modern breeding programs, leveraging sophisticated genomic tools, have yielded impressive results in both growth rates and meat quality characteristics. These gains however must be balanced against rising input costs and market demands for specific trait expressions.

Risk management strategies have evolved considerably. Producers increasingly employ sophisticated hedging programs to protect margins, though the complexity of these instruments can sometimes lead to unexpected outcomes. Market analysts emphasize the importance of maintaining adequate liquidity alongside these protection strategies.

Looking ahead, industry observers remain cautiously optimistic about sustained profitability through 2024. Domestic consumption patterns show resilience, with retail demand particularly robust in the value-added segment. The food service sector’s recovery, albeit uneven has provided additional support to pricing structures.

International trade dynamics continue to evolve, creating both opportunities and challenges for U.S. producers. While certain customary markets have contracted, emerging destinations particularly in Southeast Asia, offer promising growth potential. Regulatory compliance requirements, though, vary widely across these markets, necessitating careful strategic planning.

As the industry navigates this recovery phase, maintaining focus on operational excellence while rebuilding financial reserves remains paramount. Successful operators are those who can balance immediate capital needs against long-term strategic investments.The path forward requires careful navigation of market opportunities while maintaining sufficient financial flexibility to weather future volatility.

The current positive cycle provides a welcome opportunity for strengthening industry fundamentals. However, producers must resist the temptation to overextend, remembering the lessons of previous market cycles. Prudent capital management, coupled with strategic investment in efficiency-enhancing technologies, will position operations for sustainable long-term success.

Strategies to Maximize Capital Reinvestment During Industry Upswing

Swine Industry Profits Return: Focus on Rebuilding Capital – Pork Business

The pork industry’s financial landscape is finally showing signs of amelioration after weathering prolonged market volatility. Producer margins have rebounded significantly in Q3 2023, with average farrow-to-finish operations reporting profits exceeding $28 per head – a welcome respite from the previous year’s losses.

Many producers, having depleted their financial reserves during the challenging period are now prioritizing capital reconstruction rather than expansion. The industry’s circumspect approach reflects hard-learned lessons from the pandemic era’s market disruptions. Feed costs, while still elevated remain below their zenith from early 2022, providing some breathing room for operational budgets.

Market analysts at AgriTrends suggest that the current profit cycle could extend through mid-2024, barring any major supply chain disruptions or disease outbreaks. This prognostication has emboldened some producers to implement long-delayed facility upgrades, while maintaining their existing herd sizes. The focus on efficiency improvements rather than expansion demonstrates a more mature, risk-aware industry posture.

Remarkably production efficiency metrics continue improving despite reduced capital investment in recent years. Average pigs per sow have reached 26.4 annually in top-performing operations which representing a 2.1% increase over 2021 figures. Though these gains appear modest, they’ve proved crucial for maintaining operational viability during lean times.

The export market has been particularly robust,with shipments to Mexico and South Korea showing unexpected strength.Despite ongoing logistical challenges at major ports, international sales have surged 12.3% year-over-year. However, Chinese demand remains enigmatic and could potentially reshape market dynamics in coming months.Small and medium-sized producers are approaching the profit upswing with notable prudence. Having weathered significant equity erosion during the downturn many are prioritizing debt reduction and working capital restoration over facility expansion. This conservative stance, while potentially limiting short-term growth opportunities, reflects a broader industry shift toward financial resilience.

Environmental compliance costs continue exerting pressure on margins, particularly in regions with stringent regulatory frameworks.Producers investing in waste management systems and air quality improvements find themselves balancing regulatory requirements against capital preservation goals. Several operations reported allocating between 15-20% of their current profits toward environmental upgrades.

The industry’s labor challenges persist, with workforce availability and retention remaining significant operational constraints. Average hourly wages in pork production facilities have climbed 8.4% since January, outpacing general agricultural wage growth.These increasing labor costs are partially offset by automation initiatives, though implementation varies widely across operation sizes.Looking ahead the sector faces several pivotal considerations. Disease prevention protocols,having evolved significantly post-COVID,now represent a substantial ongoing investment. Yet these enhanced biosecurity measures have demonstrably reduced outbreak frequencies in participating operations. The cost-benefit analysis increasingly favors complete disease prevention strategies, despite their impact on operational expenses.

Technology adoption rates show captivating disparities between regions and operation sizes. While larger integrators rapidly deploy advanced monitoring systems and automated feeding technologies, smaller producers frequently enough find the initial investment prohibitive. This technological divide could potentially reshape industry competition dynamics over the coming years.

Feed efficiency improvements, driven by both genetic advances and management refinements, continue providing crucial margin support. Operations achieving feed conversion rates below 2.5:1 report significantly higher profitability, though these results vary seasonally. The relationship between feed efficiency and profitability has become increasingly pronounced as input costs remain elevated.

Industry veterans emphasize the importance of maintaining strategic flexibility while rebuilding financial strength. The current profitable period offers a chance to strengthen balance sheets, but the cyclical nature of pork production suggests caution. Most successful operators are maintaining larger cash reserves than ancient norms, reflecting heightened awareness of market volatility risks.

The road ahead presents both opportunities and challenges for pork producers. While current profits support recovery, the industry’s focus on rebuilding rather than expanding suggests a more measured approach to growth than previous cycles. This evolution in industry strategy may well define the sector’s resilience in facing future market disruptions.

Essential Risk Management Tools and Financial Planning for Sustainable Herd Expansion

Swine Industry Profits Return: Focus on Rebuilding Capital

After weathering prolonged market volatility, the pork industry is finally glimpsing daylight. Producers, having endured nearly eighteen months of losses, are cautiously optimistic about profit margins returning to sustainable levels. Market analysts project a 12% increase in producer revenues through Q2 2024, though regional variations persist.

The path to recovery remains laborious for many operations. While feed costs have moderated somewhat from their zenith in late 2022, dropping approximately $42 per ton for standard finishing rations, other input costs continue applying pressure to bottom lines. Labor expenses,particularly in processing facilities,have surged 18% year-over-year. Despite these headwinds the industry demonstrates remarkable resiliency.Efficient producers are leveraging this upturn to recoup depleted working capital. Having hemorrhaged an average of $27 per head during the downturn,many operations focused on rebuilding their financial foundations. “We’re seeing producers prioritizing debt reduction over expansion,” notes Dr. Sandra Martinez, agricultural economist at Midwest State University.”This conservative approach, while potentially limiting short-term growth opportunities, strengthens long-term sustainability.”

Feed efficiency improvements and genetic advances continue driving productivity gains across the sector. Modern facilities implementing cutting-edge automation systems report labor efficiency improvements exceeding 25 percent, which partially offsetting rising wage pressures. These technological investments, although capital intensive, are proving crucial for maintaining competitiveness in an increasingly consolidated industry landscape.

Export markets present both opportunities and challenges going forward. While demand from key Asian markets remains robust, growing by 8.3% in volume terms,logistical bottlenecks and geopolitical tensions create uncertainty. Domestic consumption patterns show promising trends, with retail pork prices having stabilized at levels supporting both producer and processor margins.

The industry’s financial recuperation varies significantly by operation size and integration model. Vertically integrated companies report faster recovery rates than independent producers, although this gap narrows when accounting for contract grower arrangements. Small to medium-sized operations implementing sophisticated risk management strategies have demonstrated particular adeptness at navigating market volatility.

Environmental compliance costs, which continuing to rise, represent a significant capital requirement for many producers. Facilities upgrading waste management systems report average investments of $175,000 to $450,000 depending on scope and existing infrastructure. These expenditures, while necessary, impact the pace of financial recovery for affected operations.

Looking ahead, industry experts anticipate continued consolidation as smaller producers struggle to generate sufficient capital for necessary modernization investments. Though,specialized niche market opportunities are emerging for agile operators. Premium programs focusing on specific production attributes command price premiums ranging from 12% to 28% above commodity markets.

Disease management protocols, having evolved significantly post-COVID, represent another area demanding capital allocation.Enhanced biosecurity measures and monitoring systems, while essential for risk mitigation, add approximately $1.75 per head to production costs. Still, these investments typically generate positive returns through reduced mortality and improved performance metrics.The lending environment presents mixed signals for producers seeking to rebuild capital positions. While interest rates remain elevated, agricultural lenders report increased willingness to support operational expansion for producers demonstrating strong management practices and solid risk mitigation strategies. Working capital requirements have increased notably, with lenders typically requiring 25% more liquidity compared to pre-2020 levels.

Industry consolidation continues reshaping the competitive landscape, albeit at a slower pace than observed during previous downturns. Approximately 4.3% of production capacity changed ownership during the past 12 months, primarily through strategic acquisitions rather than distressed sales.This trend suggests improving industry fundamentals despite ongoing challenges.

As the sector progresses through this recovery phase, successful operators increasingly emphasize operational efficiency over pure scale advantages. Innovative marketing strategies, combined with prudent capital management, characterize operations showing the strongest financial improvement. While challenges persist, the industry’s trajectory suggests a gradual return to historical profitability levels, provided external market conditions remain relatively stable.

Building Long Term Value Through Strategic Infrastructure Development and Breeding Stock Investment

Swine Industry Profits Return: Focus on Rebuilding Capital

After weathering unprecedented challenges, the pork industry’s financial outlook shows promising signs of recovery. Producers, having endured volatile market conditions and diminished returns, are finally glimpsing daybreak through the economic clouds that have long shadowed their operations.

Market analysts from AgriTrends reported that average farrow-to-finish operations saw profits increase to $28 per head in Q4 2023, marking a substantial improvement from the $12 losses experienced throughout most of 2022. This upswing, while encouraging has prompted many operators to prioritize replenishing depleted capital reserves rather than pursuing immediate expansion. The cautious approach reflects hard-learned lessons from previous market cycles.

Feed costs, which traditionally comprise about 65% of production expenses, have moderated somewhat. Corn futures hovering around $4.85 per bushel represent a welcome respite from last year’s punishing highs.Still grappling with labor shortages and infrastructure needs, producers are directing newfound profits toward modernizing facilities and bolstering workforce retention programs.

Export markets continue driving significant revenue potential despite logistical hurdles persisting in key Asian ports. China’s imports surged 28% year-over-year, while emerging markets in Southeast Asia absorbed increasing shipments of U.S. pork products. The expansion of trade relationships has provided crucial price support, even as domestic consumption patterns fluctuate unpredictably.

Small and medium-sized operations face unique challenges in rebuilding their financial foundations. Having depleted working capital during the extended downturn many producers must carefully balance immediate operational needs versus long-term investing in efficiency improvements.Industry experts suggest maintaining at least 6 months of operating expenses in reserve before undertaking major capital projects.The breeding herd shows signs of modest expansion, with gilt retention increasing 2.3% in recent months. Though, this growth remains tempered by lingering concerns about market stability and processing capacity constraints. Several major packers have announced plans to upgrade facilities, which should ameliorate some bottleneck issues by late 2024.

Disease pressure,particularly from PRRS variants,continues impacting productivity metrics in some regions. Biosecurity investments, while straining already tight budgets represent non-negotiable expenditures for maintaining herd health and production efficiency. Veterinary costs have escalated 15% since 2021, further impinging on margin recovery.

Technology adoption presents both opportunities and challenges for producers seeking to optimize operations. While automated feeding systems and environmental controls can reduce labor dependencies, the initial capital outlays can be daunting for operations still rebuilding their financial foundation. Industry leaders advocate for careful evaluation of ROI metrics before committing to major technology upgrades.

Looking ahead, futures markets suggest continued profitability through at least mid-2024, barring unexpected supply chain disruptions or disease outbreaks. Though, producers remain cognizant of the industry’s cyclical nature and are maintaining conservative approaches to expansion and capital allocation. The focus remains steadfastly on strengthening balance sheets and improving operational efficiency.

Consumer demand patterns continue evolving, with premium pork products gaining market share despite inflationary pressures. Retail prices have stabilized, averaging $4.32 per pound for center-cut chops, supporting margins throughout the value chain. The growing popularity of specialized production methods, including antibiotic-free and welfare-certified programs, presents opportunities for differentiation and premium pricing.Industry consolidation has slowed compared to previous years, though some regional operations continue exploring strategic partnerships to achieve economies of scale. Access to capital remains a critical factor,with lenders showing increased willingness to support well-managed operations with strong risk management practices.

As the industry navigates this recovery phase, the emphasis on rebuilding financial strength while maintaining operational excellence reflects a matured approach to sustainability. The lessons learned during recent market challenges have fostered a more resilient mindset among producers, who recognize that today’s profits must serve as foundation for tomorrow’s stability. Success in the modern pork industry increasingly demands balancing optimism with prudence, innovation with fiscal obligation.

Closing Remarks

As the swine industry emerges from challenging times, producers find themselves at a pivotal moment of opportunity. The return to profitability marks not just a financial recovery,but a chance to fortify operations for the future.While the path ahead demands careful planning and strategic investment, the industry’s resilience continues to prove that even after the storm, there’s always room for growth. As producers focus on rebuilding their capital reserves, they’re not just securing their own operations – they’re strengthening the foundation of tomorrow’s pork business.