Global pork markets have always exhibited a pronounced volatility, but the recent wave of retaliatory tariffs has wrought a maelstrom of disruption for U.S. producers—casting uncertainty across export forecasts and domestic operations alike. In 2025, trade-related ambiguity is estimated to curtail U.S. pork exports by nearly 7 billion pounds compared with earlier projections, signaling an epochal shift in international sentiment toward American protein suppliers.

Domestic production is now slated at 28.1 billion pounds for the year, registering as a 1.2% reduction from previous expectations finalized only in March; lighter weight categories from the autumn inventory revision are largely at fault here, manifesting through diminishing hog numbers which even heavier dressed weights barely counterbalance. While first-quarter figures suggest output near 6.9 billion pounds—down about two percent from its predecessor year—forecasts waver for future quarters: second-quarter volumes might tick upwards versus last year’s comparison but remain down relative to February’s rosier estimates.

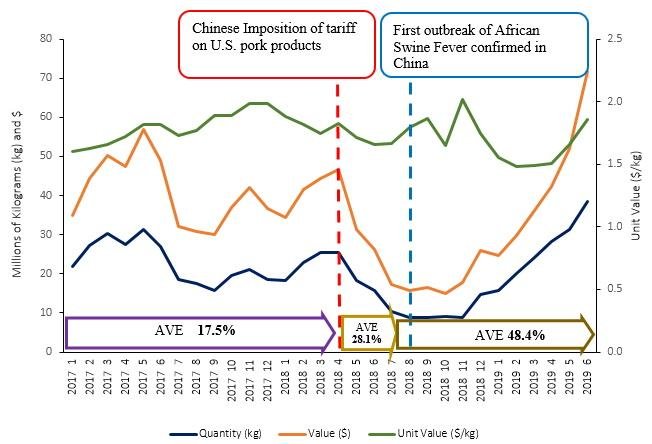

For American hog farmers set adrift by shifting policy winds overseas, tariffs catalyze both material hardships and strategic recalibrations; each new duty or reprisal decrees fresh anxieties over market access or contract fulfillment timelines that once appeared immutable (and financial risk management tools suddenly grow less reliable). Retaliation from major importers can take varied forms: not only China’s countervailing penalties but also blockades or quotas implemented by other leading economies whenever international frictions flare—the ramifications cascade rapidly through supply chains.

One dimension sometimes glossed over by analysts: while Asia continues as the preeminent consumer region into and throughout 2025—driven largely by insatiable Chinese demand—it’s not true to say any lost U.S.-to-China volume instantly finds relief via substitution elsewhere; alternative export opportunities exist albeit rarely equivalent in scale or profitability structure. The European Union, facing its own contraction amid lower production plus lackluster Chinese rebound prospects, finds solace selling more into places such as South Korea and the Philippines; this however fails to balance out what was lost on prior contracts benchmarked against pre-tariff conditions.

Curiously enough (not strictly logical perhaps given global supply dynamics), some U.S.-centric outlooks interpret rising Russian exports—as Russia cements itself both supplier-to-China and consolidator among regional competitors—as unlikely to encroach meaningfully upon western hemisphere market share despite obvious price competitiveness gains driven partly by strategic grain surpluses within Russian borders.

Against this kaleidoscopic backdrop, global pork valuations hover around $300 billion for calendar year 2025 with CAGR near 3.5% since early decade measurements began ticking sharply upward; China alone commands half all world pig output in metric tonnage—a system almost unfathomably complex yet sensitive to every sanction or sudden regulatory edict imposed halfway around the globe.

The United States holds third place among exporters worldwide (after China and EU), wrestling myriad headwinds generated not just externally but domestically: shifts in national dietary preferences—a seemingly minor footnote on spreadsheets where macroeconomic numbers otherwise dominate discussions—and mandatory sustainability frameworks complicate previously linear expansion models adopted post-2018 tariff rounds.

Profitability projections further reflect these border-crossing variables with cautious optimism tempering agricultural economic reports late last winter: optimistic operators anticipate some enduring tailwinds rolling over from improved fourth quarter margins in late-2024 even as tariff-fueled price compressions threaten longer-run viability for weaker players within fragmented state markets once buffered exclusively by robust foreign off-take agreements now rendered tentative at best—or occasionally annulled outright sans recourse provisions enforceable under prevailing WTO jurisprudence protocols (jury still out on how certain bilateral disputes may resolve).

Nevertheless—not all sectoral developments spell doom nor retrenchment—for select highly capitalized firms able swiftly pivot logistical pipelines into emergent secondary geographies (Latin America seeing incrementally rising per capita pork consumption coupled with streamlined customs regimes) resilience endures if unevenly distributed geographically across North American producer baselines versus their multinational conglomerate rivals headquartered abroad who face parallel price pressures albeit mitigated somewhat via vertical integration advantages unique outside of USDA-regulated systems.

In summation though clarity eludes absolute capture amidst surges of contradictory policy initiatives emerging monthly worldwide—the exogenous shocks delivered via tit-for-tat tariffs continue echoing across contract desks and farmyards alike; today’s tactical missteps become tomorrows’ structural reckonings until equilibrium returns either organically through negotiation resets or forcibly when cost-plus pricing ceases covering escalating capital expenditures fundamentally necessary just sustaining existing herd genetics against relentless biosecurity threats endemic throughout every phase of live-animal transportation networks globally observed—not always consistently regulated depending upon jurisdictional fluxes coinciding precisely when least convenient for stateside operators hoping merely to recover ground lost since late last decade’s trade détente evaporated practically overnight after protracted cross-Pacific haggling reprised anew earlier this springtime season would show several shades more complicated than previously imagined possible even five years before now elapsed unseen behind headlines focused nearly exclusively on soya yields rather than porcine pagination concerns encroaching commodity futures brokerage floors month-by-month henceforth indefinitely perhaps unless soon reversed entirely—a proposition uncertain as ever proved beneath shifting clouds encompassing every continent where bacon remains king—though no longer unchallenged anywhere it seems anymore!