Two major Chinese enterprises—one rooted in agri-business, the other immersed in artificial intelligence—are setting their sights on the fertile financial landscape of Hong Kong’s IPO market. This simultaneous ambition, occurring against a backdrop of escalating US-China trade frictions, signals both corporate adaptability and confidence in Hong Kong’s enduring allure as a capital-raising hub. The sudden flurry almost feels like a response to shifting political winds rather than long-term strategy.

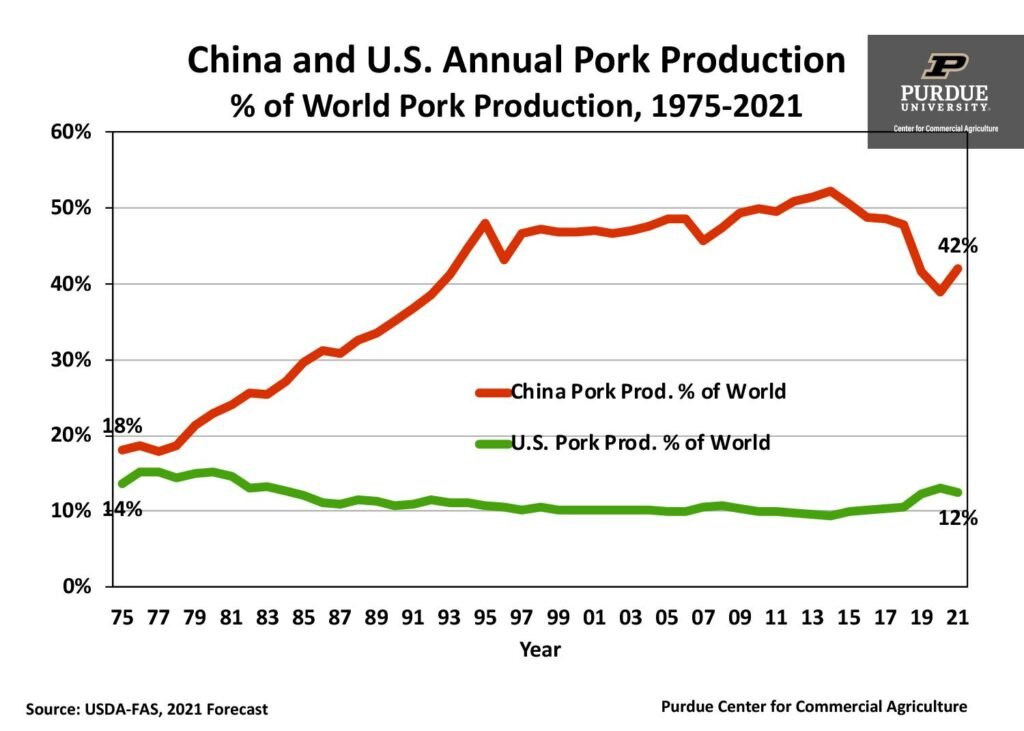

Shenzhen-based Muyuan Foods, with origins dating back to 1992, stands among the planet’s foremost pork producers. Its influence within global swine breeding is significant; present day output levels place it near the apex of pork production worldwide. Muyuan announced intentions to pursue a secondary listing on Hong Kong’s main board within two years—a move concealed behind careful official filings but widely interpreted as an international expansion gambit. Market whispers estimate this IPO could generate roughly US$1 billion for Muyuan. Recent trading has shown fluctuations: shares saw an uptick of 0.5 percent one morning but also experienced brief dips exceeding one percent at other times (share price graphs probably wouldn’t reveal astounding volatility). Presently valued at approximately 204 billion yuan (US$28 billion), its market capitalization belies this year’s approximately three percent slip amid broader compositional shifts.

China’s agricultural sector contends with structural issues: meat demand is tapering off even as post-African swine fever recovery has flooded markets with surplus pork supplies. That combination compresses margins for pig farmers as prices soften despite rising input costs—a paradox that complicates capital planning yet increases urgency for firms seeking diversified funding streams overseas.

Muyuan isn’t alone at Hong Kong’s gates; Beijing-headquartered Deepexi Technology has quietly filed papers under Chapter 18C regulations—the bourse’s specialist designation tailored for high-growth tech innovators. Deepexi specializes in enterprise artificial intelligence solutions reaching customers across borders; their business model exemplifies China’s push into sophisticated software ecosystems outpacing traditional manufacturing exports.

Sixteen companies lodged applications with Hong Kong Exchanges and Clearing within just two weeks this spring—a remarkable cluster reflecting not only tactical decisions by individual firms but also macroeconomic realignments catalyzed by regulatory encouragement from Beijing (conspicuously absent have been more pronounced public dissent over these moves). While some observers anticipated sluggishness owing to persistent trade crosswinds or policy uncertainty, what occurred evidently was something altogether different: an unimpeded rush toward Asia’s most vibrant equity market stage.

Analysts see patterns here shaped partly by government exhortations aimed at leveraging offshore financial resources without sacrificing domestic control structures; past successes by blue chips such as CATL or Midea Group reinforce that narrative even if sector fundamentals diverge sharply between AI software and intensive livestock operations.

Interestingly enough—in comparing these trajectories—it might seem despite superficial contrasts each firm faces similar hurdles when raising international capital: disclosure standards differ from mainland exchanges; investor bases diversify considerably once shares float outside home territories; geopolitical perceptions gnaw quietly at valuations though not always obviously affecting subscription levels during book-building phases (except maybe when they do).

The scale remains impressive yet somehow lopsided if you look too closely at timing details across applicants—which occasionally causes confusion when parsing total cumulative volumes raised versus individually targeted proceeds among peers scrambling up what appears sometimes like parallel ladders towards overlapping goals rather than distinct objectives entirely separate from each another (even though they mostly are distinct).

Hong Kong listing venues entice because secondary offerings there can supplement liquidity while enabling exposure among institutional investors drawn specifically toward emerging-market giants whose reach now frequently extends far beyond protected provincial confines—or so shareholder prospectuses assert with varying degrees of realism or reserve depending upon audience sophistication levels.

And while regulatory frameworks adapt somewhat fitfully in reaction to industry feedback—note particularly recent rules pertaining both to biotech floatation and deep-tech admissions under Chapters newly amended—it would be inaccurate suggesting company agendas are always driven principally by compliance incentives instead of organic strategic ambitions devised internally long before application paperwork formalities commence rolling through HKEX systems.

What decision-makers inside Muyuan and Deepexi ultimately hope is clear enough: that broadening shareholder bases accelerates access not solely to working capital but also intangible international credibility sleeping just beneath metric headlines touting proceeds numbers or initial free-float percentages after debut.

In conclusion—not every aspect lines up tidily nor should it—but these dual moves underscore how differently situated sectors often seize concurrently upon fleeting openings provided by regional regulatory adaptations amid global economic flux so pronounced its effects have become almost prosaic through frequency alone among seasoned analysts trying desperately not simply catalogue events but discern durable meaning hidden underneath them all—even elbows-deep in corporate filings filled simultaneously with optimism and reticence alike.