An air of anxiety currently surrounds the U.S. meat export sector, owing not only to mounting tariffs but also to the precarious status of plant registrations with China. Hundreds of American processing plants have been teetering near a pivotal deadline as required Chinese export registrations approach expiration—ushering in an era where longstanding protocols, which once seemed etched in stone, suddenly appear anything but certain.

Industry observers once described the connection between U.S. beef exporters and Chinese consumers as a crucial aspect underpinning market dynamism—in 2024 alone, $1.6 billion worth of American beef found its way into China’s supply chain. The stakes extend much further than steak and ribs: In total for 2024, all forms of meat and edible offal exports from America to China touched $2.83 billion. Bovine animals frozen or otherwise processed accounted for substantial revenue slices; poultry chilled or fresh sat beside pork products on the ledger.

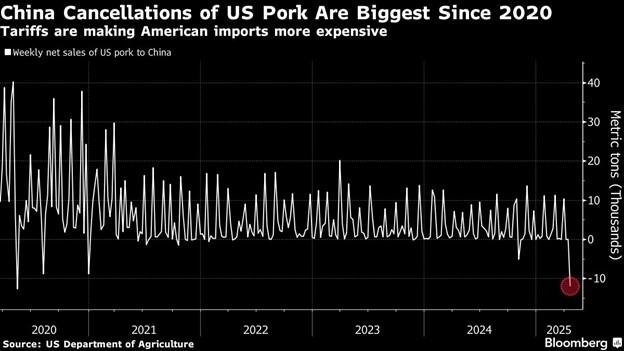

Yet this intricate trade system does not exist in isolation. Recent months witnessed Beijing escalate retaliatory duties against American meats at a pace no one predicted last winter—pushing effective tariffs for pork up to 172%, while beef saw levies soar to roughly 147% by springtime. These remarkable increases aggregate both longstanding Most Favored Nation (MFN) rates with several extra layers: previous Section 301-related retaliations and newly-announced penalties announced first at 34%, bumped swiftly (or abruptly?) higher—an embattled industry can hardly keep up with each regulatory swerve.

These compound tariffs form an unnatural barrier around what was once considered fluid international commerce. Producers must now puzzle over not only whether their next shipment will leave port unimpeded but even if such shipments remain permitted under expired or soon-to-expire facility codes—a Kafkaesque riddle that could have been borrowed from a Beckett playbook if it weren’t cruelly real right now.

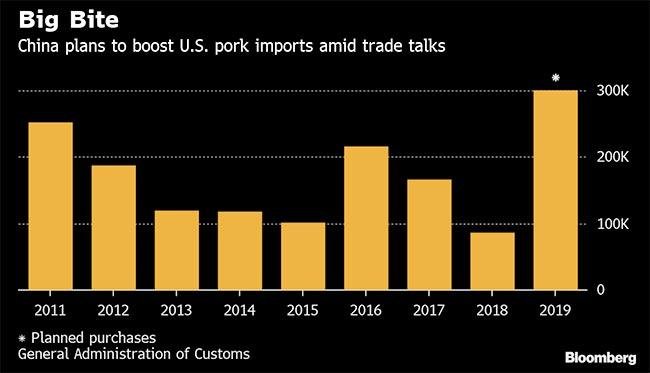

Oddly enough, despite all those headwinds (and perhaps due in part to their own inertia), U.S.-origin meat retained considerable presence within Chinese markets through early 2025; January beef exports actually climbed by more than a third compared with dreary figures seen one year earlier—harbinger of resilience or evidence that paperwork backlogs are masking deeper trouble? Probably both at once. Pork did better in some periods—it does make you wonder if these numbers reflect lagging registration expiries rather than robust demand fundamentals after duties kicked up like so much Midwest dust.

The registration impasse isn’t uniform across animal proteins either: Dairy and poultry processors recently received renewals from Beijing’s authorities while cattle-based operations were left wandering along a bureaucratic backroad still awaiting overdue attention from across the Pacific Ocean—a phenomenon hinting perhaps less about food safety concerns than political signaling embedded deep in administrative processes. From time to time policy choices ripple out into areas nobody anticipated—even sausage recipes undergo subtle revision when upstream paperwork trips over itself amid translation issues.

American producers accustomed to scaling sticky wickets abroad find themselves weighing risks differently today: Beyond price competition sits regulatory uncertainty unfolding like storm clouds above every feedlot gatehouse—and sometimes creative workarounds arise when old routes close unexpectedly though few would reminisce fondly about them after midnight shift changes end empty-handed.

It’s worth noting these disruptions ripple through complex value chains far removed from first impressions—for instance, taking China out of America’s strategic mix punches holes into pricing power even within Japan, Korea, Taiwan—and fissures emerge along financing pipelines stretching between farm lenders and commodity traders whose models now must be rebuilt atop less solid groundwork.

A curious observer might spot another oddity here—a logical step followed by sudden retreat: Last month some analysts forecasted an all-but-certain swift decline in export volume following duty hikes; however recent data showed brief volume upticks defying textbook predictions before gravity asserted itself again on wholesale prices elsewhere across Asia-Pacific locations—the pattern recalls skittish livestock dashing unpredictably at unfamiliar thunderclaps before resuming grazing when chaos passes briefly overhead.

What lies ahead? Negotiations may calm waters—or send new waves crashing toward this industry already wearing worry lines deeper than last year’s drought cracks atop prairie earth. While optimism persists among certain circles that diplomacy can unclog stalled approvals sooner rather than later—it is just as plausible operators may need contingency plans rivaling Rube Goldberg inventions simply to maintain throughput volumes near historic norms.

In years past—when “beef diplomacy” went hand-in-glove with global summits—the working assumption had always been mutual benefit driving cooperation forward faster than friction could erode trust on either side; yet recent events suggest those handshakes don’t carry quite so much momentum anymore if protocol gets coerced into paradoxical corners.

Still—even under pressure harsh as rawhide left too long beneath midsummer sun—the ingenuity embedded throughout America’s livestock sector inspires cautious hope that whatever detour emerges next will generate novel pathways trading partners never intended but may eventually recognize necessity disguised oddly as opportunity. And sometimes even bureaucratic traffic jams resolve themselves overnight—for reasons nobody entirely understood anyway—but maybe we’ll just cross that bridge when we reach it since many forgot exactly why it was built there first place anyway.