China’s Unexpected Pork Rejection Reshapes Agricultural Trade Landscape

In a remarkable development last week, China abruptly canceled 12,030 metric tons of American pork shipments that were already paid for, packed, and in transit across the Pacific. This represents the largest cancellation of U.S. pork exports to China since May 2020, during the early stages of the COVID-19 pandemic. The unexpected maneuver has sent tremors through agricultural markets and beyond.

The timing seems far from coincidental. Just three weeks before the cancellation, the Trump administration had imposed a substantial 172% countervailing duty on all pork imported from China, citing illegal subsidies and veterinary violations. Rather than responding with matching tariffs or diplomatic outbursts, Chinese officials maintained a strategic quiet before executing this precise cancellation.

When questioned, Chinese Foreign Ministry spokesperson Linian denied any connection between the tariffs and the canceled shipment. Internal documents, however, suggest otherwise. Trade analysts at Fudan University view this not merely as a dispute about pork but rather as a calculated message that “legacy commodities are no longer untouchable”. The rejection carries profound symbolism in the ongoing economic tension between global giants.

The financial implications resonate deeply with American producers. Valued at approximately $35 million by current market prices, the canceled shipment has created a domestic surplus of 26 million pounds of pork – equivalent to about 110,000 hogs suddenly redirected into an already saturated U.S. market. Iowa, North Carolina, and Minnesota, which collectively account for nearly 60% of U.S. pork exports to China, have absorbed the heaviest consequences.

Brazil and Spain appear positioned to capitalize on this friction. These nations swiftly moved to fill the vacuum left by American exports, suggesting foreknowledge of China’s intentions. Agricultural experts speculate this represents more than temporary market disruption – it reveals China’s broader strategy to diversify its agricultural supply chains away from U.S. dependence.

“This is a targeted response from China to hurt parts of the [U.S.] that are red,” explained Dexter Roberts, senior fellow at the Atlantic Council’s Global China Hub. Many American farming regions traditionally vote Republican and supported Donald Trump in the previous election. “People are very aware of this and very worried,” Roberts added. “One bad year and you might be mortgaging the farm”.

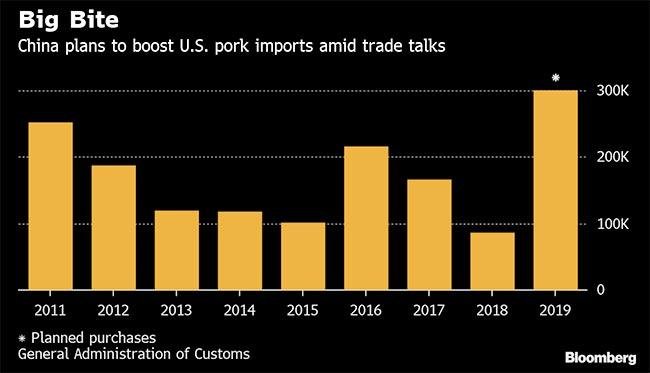

The trade implications extend well beyond pork. China purchased more than 475,000 metric tons of American pork in 2024, worth over $1 billion. Yet industry observers view pork as merely the opening salvo in a gradually expanding trade confrontation. Soybeans, corn, and beef might encounter similar obstacles in the Chinese market as tensions intensify.

Some analysts even suggest China’s approach reflects a purposeful “precision decoupling strategy,” through which Beijing could methodically reduce dependence on American agricultural products while minimizing domestic market disruption. At the tactical level, this represents increased economic leverage; at the strategic level, it signals potential long-term repositioning in global trade relationships.

The pork cancellation possibly signifies China’s willingness to apply similar precision to other sectors. When 12,000 metric tons of pork gets rejected mid-shipment, that’s not merely logistics – it’s leverage. The question emerges: if China can phase out U.S. pork with such surgical precision, what happens when they target semiconductors, pharmaceuticals, or even treasury bonds with identical quiet determination?

American farmers caught in this geopolitical crossfire face immediate concerns. Despite most not relying exclusively on Chinese demand, a sudden market closure of this magnitude creates substantial ripples. Hog producers must now manage unexpected surplus amid seasonal oversupply, potentially leading to price declines that compress already narrow margins.

The real impact might manifest not through dramatic announcements but through quieter, incremental adjustments in global supply chains. While headline-grabbing tariffs draw attention, these precise market manipulations could reshape trade patterns with more lasting consequence. They represent not just economic calculation but strategic messaging in the complex language of international relations.